Life Insurance Corporation (LIC) which is set for the country’s largest ever initial public offering (IPO) on Tuesday reported a spike in its profit after tax for the first half of the financial year 2021-22.

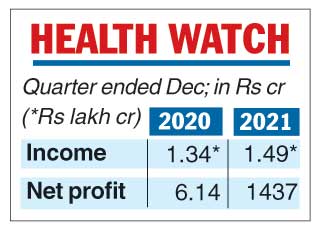

The insurer posted a net profit of Rs 1,437 crore as compared to Rs 6.14 crore in the year-ago period.

This came after its overall income from investments shot up to Rs 1.49 lakh crore from Rs 1.34 lakh crore in the year ago period.

In a statement, LIC said that its new business premium growth rate stood at 554.1 per cent in the first half, compared with 394.76 per cent during the corresponding period of the preceding financial year.

The state-owned insurer reported a jump of Rs 17,404 crore in overall premiums and income from investments grew to Rs 3.35 lakh crore in the April-September 2021 period.

During the reporting period, the life insurer reported an increase of Rs 7,262 crore in the total premium to Rs 1.13 lakh crore for individual life (non-linked plan which are traditional products). On the other hand, the total premium in individual life (linked which are combination of insurance and insurance product) increased by Rs 737.08 crore to Rs 1,085 crore.

The much awaited IPO of LIC is expected to happen in March and reports say that the centre could raise around $ 12 billion from the share sale.

Last year, the Government has appointed 10 merchant bankers including Goldman Sachs (India) Securities, Citigroup Global Markets India, and Nomura Financial Advisory and Securities India to manage the mega public offering of the insurer. The others include SBI Capital Market, JM Financial, Axis Capital, BofA Securities, JP Morgan India, ICICI Securities, and Kotak Mahindra Capital Company. Earlier, the actuarial firm Milliman Advisors LLP India was appointed to assess the embedded value (a valuation metric of insurance companies) of LIC.