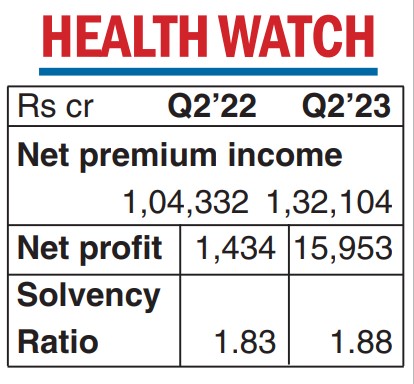

Life Insurance Corporation of India has posted anet profit of Rs 15,952.5 crore for the quarter ended September 30 as the insurance major transferred Rs 14,271.80 crore from non-participating funds to shareholder’s account asper regulatory disclosure.

The life insurer had posted a net profit of Rs 1,433.71 crore in the corresponding quarter previous year.

There was speculation that LIC will transfer a much larger sum of Rs 1.8 lakh crore. It remains to be seen whether in the coming quarters further transfer to the shareholder’s fund takes place.

“In accordance with the IRDAI letter dated 10/11/2022and subsequent approval by the board of directors, the corporation has changed its accounting policy and has transferred an amount of Rs14,27,180.41 lakh (net of tax)pertaining to the accretion on the available solvency margin from non-par to shareholder’s account due to which the profit for the quarter and half year ended 30/09/2022 has increased to that extent,” LIC said in its earnings statement to the stock exchanges.

LIC said that it has carried out the transfer based on a limited review of the financial statements and the actuarial valuation of the policy liabilities by the appointed actuary. Life insurance companies in India sell participating policies and non-participating policies. Profits are shared with customers in case of participating policies, while non-participating policies have fixed returns and the profits are collected in a fund.

The transfer from the non-participating fund to shareholder's account is away to shore up investor confidence and it could act as an indicator of higher dividend payouts in the future.

The net premium income of LIC was Rs 1.3 lakh crore during Q2 compared with Rs1.04 lakh crore a year ago, a growth of 26.61 per cent. Expenses of management have shot up to 18.25 per cent from14.92 per cent a year-ago.