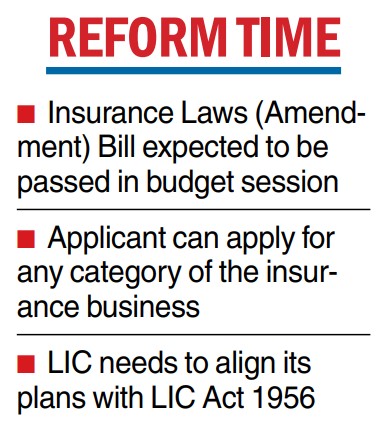

The country’s largest insurer LIC may take a call on the composite licence clause after the passage of Insurance Laws (Amendment) Bill in Parliament, sources said.

According to the bill, an applicant may apply for registration of one or more classes/ sub-classes of the insurance business of any category or type of insurer.

However, reinsurers are prohibited from seeking registration of any other class of insurance business. A composite licence will allow insurers to undertake general and health insurance via a single entity.

Sources said LIC would take a call on the composite licence and other issues emanating out of passage of the Bill in a comprehensive manner taking into consideration Life Insurance Corporation Act, 1956.

The bill, with proposed amendments to the Insurance Act 1938 and Insurance Regulatory and Development Authority Act, 1999, is expected to be tabled in Parliament in the upcoming budget session starting next month, sources said.

If the proposal for composite insurance registration is passed, there would be change in solvency margin and capital requirement for these companies.

The proposed amendments suggest that the minimum paid up capital be specified by the Insurance Regulatory and Development Authority of India (IRDAI) considering the size and scale of operations, class or sub-class of insurance business and the category or type of insurer. Currently, solvency ratio is pegged at 150 per cent, while paid up capital is Rs 100 crore as per the existing law.

The finance ministry has recently circulated for wider consultation the amendment in insurance law, including reduction in minimum capital requirement, with a view to enhancing insurance penetration, improve efficiency and enable product innovation and diversification.

Insurance penetration in India during 2021-22 was 4.2 per cent, remaining the same as in 2020-21. Insurance density in India increased from $78 in 2020-21 to $91 in 2021-22. The level of insurance density has reported consistent increase from $11.5 in 2001-02 to $64.4 in the year 2010-11.

The proposed amendments focus on enhancing the promoting policyholders’ interests, improving returns to the policyholders, facilitating entry of more players in the insurance market leading to economic growth and employment generation, enhancing efficiencies of the insurance industry — operational as well as financial and enabling ease of doing business.