The 2020 decade is going to be a challenging one. It started amidst an economic slowdown, and now we’re in the middle of a once-in-a-lifetime pandemic. Job losses, pay cuts and uncertainty are the order of the day. These are hard times for youths just starting out in life.

The Early Jobbers — those between the ages 22 and 27 and at the start of their careers — are having to deal with unique challenges, including being smart about how they manage their limited money. The pandemic is teaching us many lessons in money management. We’d do well to burn the lessons into our memories.

Save up!

You’ve probably started working and earning an income. But you’re not truly financially independent if you don’t have savings. Any crisis such as a loss of job or poor health may trigger a financial emergency in your life, making it difficult to make even essential spends such as rent.

Your humble savings account lays the financial foundation of your life, making it possible for you to sustain yourself, create wealth, and be secured against life’s vagaries. In these last few months, countless people have encountered financial hardships. But who had been saving for years were able to sustain themselves better than those who weren't saving.

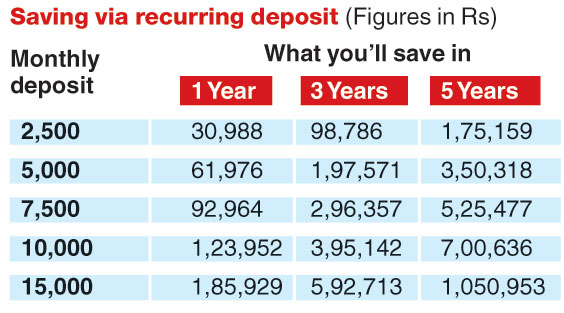

As a thumb-rule, aim to save at least 20 per cent of your monthly income, and have at least three to six times your currently monthly income saved up in your bank as a fixed deposit or recurring deposit. This is your emergency fund -— the fund you dip into when you run into trouble. Once you’ve reached 6X, keep going. Aim for 12X, or any number you consider adequate based on your unique needs.

The Telegraph

Be insured, always

In these last few months, you may have come across countless funding requests from the families of Covid-19 patients. In many of these cases, the affected parties didn’t own any form of health insurance and, therefore, struggled to pay their medical bills.

Hospitalisation can brutalise your life savings. There have been reports of hospital bills running into lakhs of rupees in some of the more complicated Covid-19 cases.

You’re young, but do not make the mistake of thinking that healthcare costs aren’t your problem. Life is delicate; your finances even more so.

You do not want a hospitalisation to exhaust your hard-earned money. Therefore, always own health insurance.

Start with a basic cover of at least Rs 5 lakh. In your 20s, you have the advantage of good health and low premium costs. Not just that, ensure that everyone in your family is insured similarly. This will help you not just avail quality healthcare but also protect your family’s savings.

Don’t chase popular choice

Your timeline may be full of news about the prices of gold hitting new highs every week. Earlier this year, the stock markets tanked in the wake of the pandemic but have already made a strong recovery. You must be wondering which of these options to chase in order to create wealth for yourself.

Recently, a personal finance expert had said that when you eat a meal, you don’t ask yourself if you want to eat rice or vegetables or meat. In other words, just as a balanced diet consisting of many different food in the right mix is the healthy choice, your investments too should be a well-balanced mix of instruments chosen according to your aspirations.

Therefore, don’t chase last year’s winners. Those who accumulated gold at prices of around Rs 30,000 are now gaining from its ascent to Rs 50,000. But if you try to get into the game at Rs 50,000, it could be a while before you make any money.

Focus on creating the all-weather investment portfolio including a mix of bank deposits, mutual funds, gold, equity, small saving schemes such as provident fund, and real estate.The key word: diversify.

Repay debt aggressively

When the going’s good and the economy is booming, money is easy to make and easier to spend.

Loans can be easily available, too, to finance every little want and need. But that’s the time you should exercise caution and fortify your finances using the above-mentioned ideas.

Because when the economic cycle turns and you find yourself in the kind of difficult scenario we're currently in, your hardships will be far less due to your prudence, planning, and foresight.Using borrowed money smartly is also integral to this.

During the lockdown, many people had to make the difficult choice of not paying their EMIs.

The inability to service debts can put your finances at risks such as having to pay higher interest later, liquidate assets for cash, or taking on even more debt to repay existing debts. Therefore, aggressively repay your debts so that when you find yourself in a spot, your loans will be less of a problem for you.

A downturn is a difficult place to be in today. However, the cycle will turn, and there will be better days. However, we must carry with us the lessons of this once-in-a-lifetime crisis we are in.

The writer is CEO, BankBazaar.com