The shares of Zee Entertainment Enterprises Ltd spiked on Monday after the promoters of the Essel group got a three-month reprieve from lenders to complete a proposed strategic sale. The lenders have also agreed not to sell the pledged shares of the promoters.

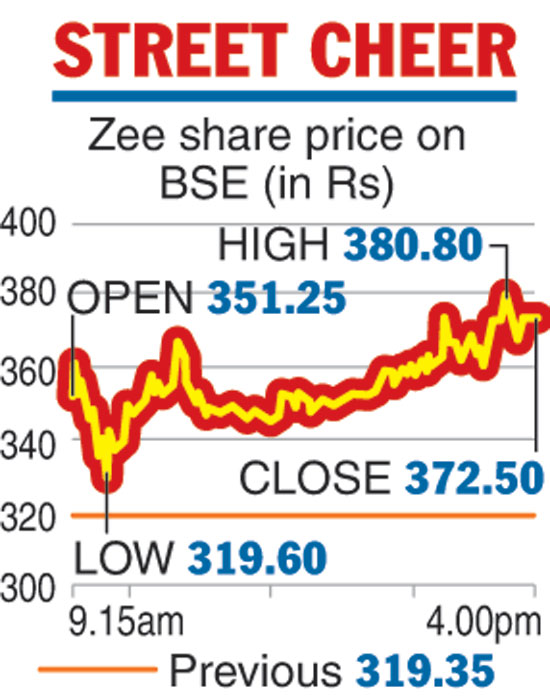

The Zee scrip on Monday rose 16.64 per cent, or Rs 53.15, on the BSE to settle at Rs 372.50, after surging over 19 per cent in intra-day trade to hit a high of Rs 380.90.

Last Friday, the share had sunk more than 26 per cent on reports the Serious Fraud Investigation Office (SFIO) is probing a firm, Nityank Infrapower, for deposits of over Rs 3,000 crore made after the demonetisation; and that Nityank and a group of shell firms carried out financial transactions that involved a few firms associated with the Essel group. The fall in the share price was also on account of apprehensions over the pledged shares of the promoters.

While Zee, Dish TV and Essel Propack have denied links with Nityank, the sharp jump in the share price of Zee came after the management held a conference call with analysts on Monday.

The Telegraph

The management said the group has arrived at an understanding with lenders who are having a pledge on the shares of the promoters. One of the reason for the decline in the share price of Zee last Friday was the invocation of pledges by some lenders.

According to a note from JM Financial, the promoters (Essel Group) owned 41.6 per cent of Zee as of December 2018, and 59.4 per cent (237 million shares) of their stock was pledged with the lenders. The note said around 6.5 million pledged shares were sold on Friday, reducing Essel Group’s stake to around 40.9 per cent.

Friday’s share crash led to a breach of covenants leading to the risk of more invocation. The management said a meeting of the group promoters with mutual funds, NBFCs and banks were held. During the meeting, an understanding was reached wherein the lenders said “there will not be any event of default declared due to the steep fall in price.

The Essel group is planning to sell up to a 50 per cent of the promoters’ equity in Zee to a strategic partner to retire the debt of the promoters. However, the exact debt of the promoters could not be ascertained.