The success of Bharat 22 ETF and the strategic sale of Pawan Hans and Rural Electrification Corporation are likely to result in the government meeting the Rs 80,000-crore divestment target set for the current fiscal.

Analysts expect entities such as the LIC to come to the rescue to buy stakes and meet the target.

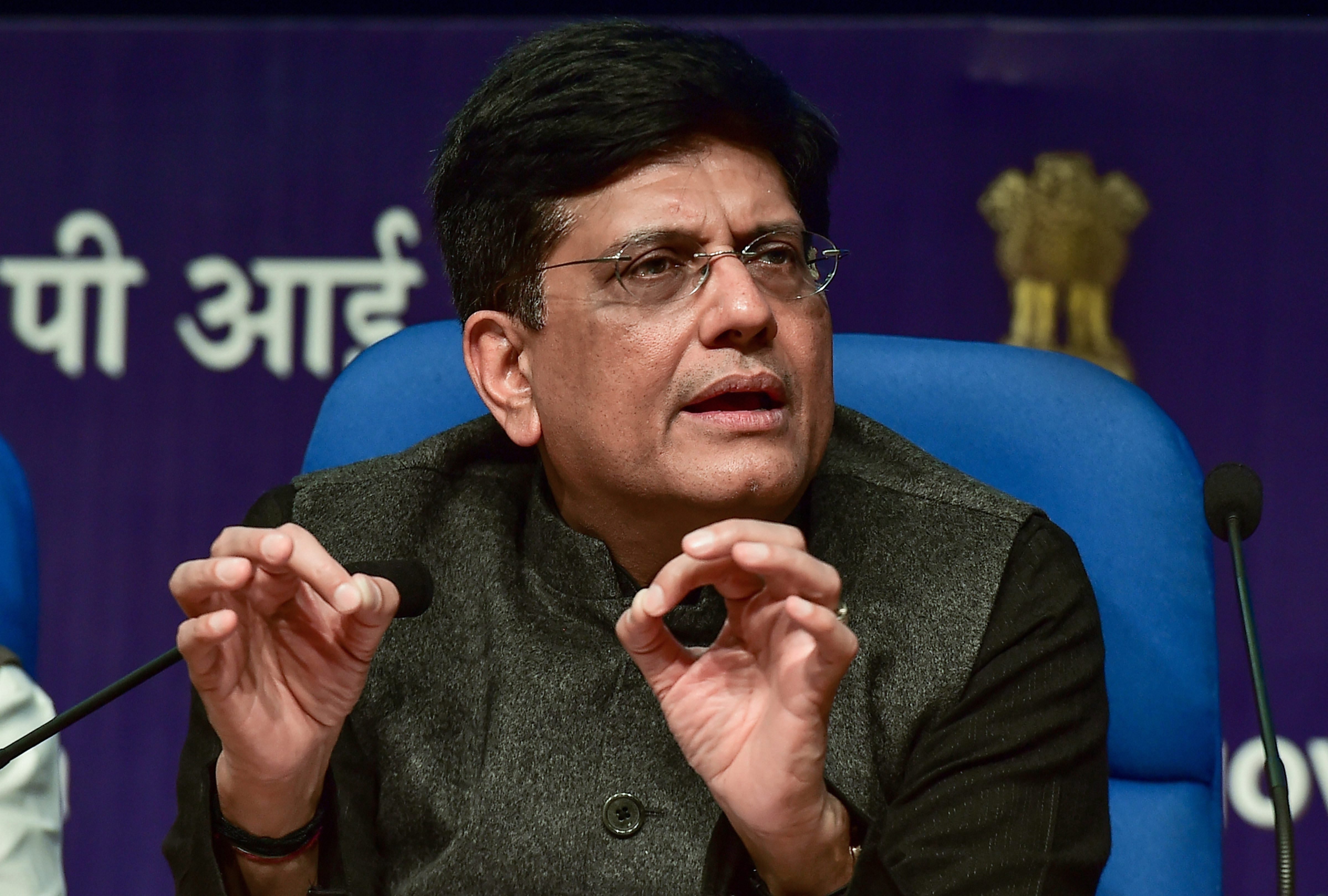

Finance minister Piyush Goyal has expressed confidence in meeting the target for the current fiscal and has increased the target for the next fiscal by Rs 10,000 crore to Rs 90,000 crore.

“The government received over Rs 1 lakh crore from divestment proceeds during 2017-18. We are confident of crossing the target of Rs 80,000 crore this year,” Goyal said.

So far, the government has received Rs 35,533 crore from the divestment proceeds, according to the latest figures from the department of investment and public asset management. With just two months left, the government needs to carry out divestments worth Rs 44,467 crore.

The government hopes to meet the target with another round of Bharat 22 ETF, the strategic sale of Pawan Hans and the sale of government’s stake in state-run REC to Power Finance Corporation to meet the target for second fiscal in a row.

“After surpassing the divestment target in 2017-18, the government expects to achieve that target of Rs 80,000 crore in 2018-19. The target set for 2019-20 is 12.5 per cent higher than 2018-19 at Rs 90,000 crore. The remaining target for the current fiscal could be met by a buyback of shares by PSUs or stake sale of PSUs to other public entities, namely Life Insurance Corporation,” Care Rating in a note said.

The strategic divestment of Pawan Hans is also expected to be completed by March 2019, officials said.

“The divestment target is still being maintained while it looks increasingly difficult to achieve,” Ranen Banerjee, partner & leader, public finance and economics, Pwc, said.

“The government plans to launch the next tranche of Bharat 22 ETF later this month… potential to garner up to Rs 10,000 crore through the exchange-traded fund without rebalancing the index,” officials said.

The Bharat 22 ETF, which was launched in 2017-18, has 16 central public sector enterprises covering six sectors, three public sector banks and three private sector companies where the Specified Undertaking of Unit Trust of India has stakes. The companies in the ETF include ITC Ltd, Larsen & Toubro Ltd, ONGC, Indian Oil, SBI, Bharat Petroleum Corp Ltd and Coal India Ltd.