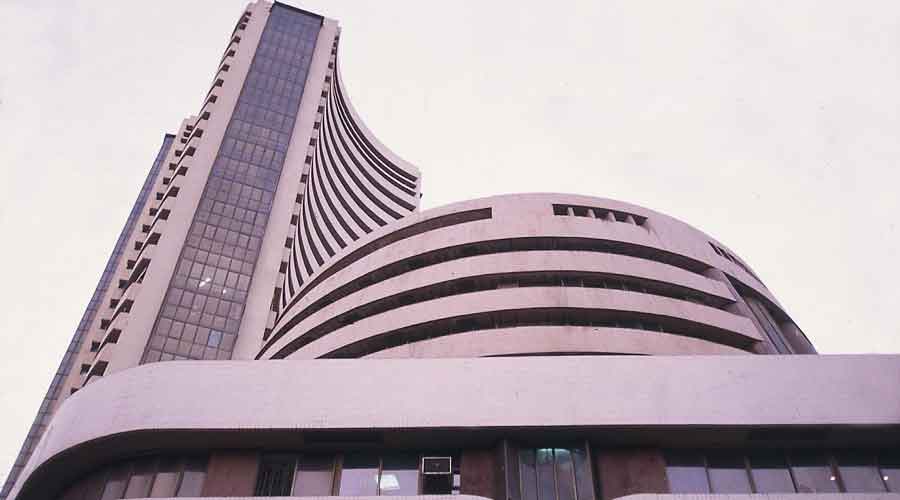

Equity indices tripped in the last half-an-hour of trade on Tuesday to notch up losses for the fifth consecutive session because of concerns over rising inflation, lacklustre corporate results amid escalation in hostilities between Russia and Ukraine.

The Sensex tanked 703.59 points to end at 56463.15 points after collapsing almost 1158 points to an intra-day low of 56009.07. At the NSE, the broader Nifty 50 finished 215 points down at 16958.65.

“Bears attacked the market, especially in the last hour. The market remained resilient throughout the day but then there was a sudden sell-off and we can say that there could be large FII selling post 2:30pm,” said Parth Nyati, founder, Tradingo.

Market circles said investors got worried over the adverse impact of rising inflation with no let-down in the Russia Ukraine conflict.

Continued selling by the foreign portfolio investors (FPIs) and uninspiring results from HDFC Bank and Infosys affected sentiment.

Provisional data from the stock exchanges showed FPIs sold stocks worth Rs 5,872 crore on Tuesday against a sale of Rs 4,255 crore in the whole of last week.

In this calendar year, the foreign investors have withdrawn almost Rs 1.14 lakh crore from equities as headwinds such as rising inflation and higher interest rates have increased the attractiveness of other safe haven assets.

Discouraging corporate results is another factor behind investor woes.

The Street is unimpressed by HDFC Bank results which was announced on Saturday although they met analyst estimates.

Shares of the private sector bank slipped 3.73 per cent to end at Rs 1,343.30, while parent HDFC plunged 5.50 per cent to Rs 2,138.65.

Since the announcement of the merger between the duo, HDFC Bank has cracked 19 per cent, while the HDFC counter has lost a little over 20 per cent of its value. Their combined market cap dropped over Rs 2.70 lakh crore.

“Intensification of geo-political tension and hyperinflation as crude and metal price rise worried the market. The IT sector continued to lead the downtrend following sectorial headwinds highlighted in weak fourth quarter results. Quick sell-off was witnessed during the closing hours led by banking stocks because of FII selling as global market weakened,’’ Vinod Nair, head of research at Geojit Financial Services, said.

Rupee falls

The going was also not good for the rupee which traded at four week lows and plummeted 22 paise to end at 76.51 to the dollar.

The domestic currency was weak on account of selling pressure in the equity markets and a stronger dollar.

According to Siddhartha Khemka, head — retail research, Motilal Oswal Financial Services, the intensifying war between Ukraine and Russia has once again dampened the sentiment, which coupled with rising inflation, bond yields and dollar index has put investors on edge.

He said the weak earnings season so far has contributed to the selling pressure, and the Nifty could head towards the 16600 levels.

“Till the global situation does not stabilise we recommend selective approach in the market’’, he said.

The going was also not good for the rupee which traded at four week lows and plummeted 22 paise to end at 76.51 to the dollar. The domestic currency was weak on account of selling pressure in the equity markets and a stronger dollar.