Shares of Kotak Mahindra Bank on Friday surged after reports that Warren Buffett’s Berkshire Hathaway may pick up a stake in the private sector lender.

However, the Kotak scrip surrendered some of its gains after the bank clarified that it was not aware of any such plans.

The buying in the counter came after a business news channel reported that Berkshire Hathaway is looking to buy up to 10 per cent in the bank either through a preferential allotment or by buying the promoters’ stake, adding that the deal could be valued at $4-6 billion.

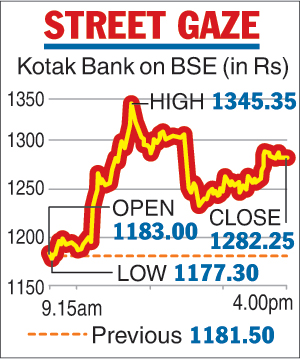

The report led to shares of the bank surging almost 14 per cent during intra-day trade to hit a day’s high of Rs 1,345.35.

However, the counter gave up some of these gains to close at Rs 1,282.25 on the Bombay Stock Exchange, still a rise of 8.53 per cent, or Rs 100.75, compared with the previous close.

This came after Kotak Mahindra Bank denied any such talks through a clarification to the stock exchanges.

The lender said that “it is unaware of any plans by Berkshire Hathaway buying a stake in the bank’’.

India is, however, not new to Berkshire Hathaway.

In August, the conglomerate had picked up a stake in One97 Communications Ltd, the parent of digital payments firm Paytm, which was its first investment in an domestic firm.

Under the extant RBI guidelines, Uday Kotak, the promoter of Kotak bank, has to bring down his stake to 20 per cent by December 2018 and 15 per cent by March 2020.

Citing the December deadline, market observers said whatever has to happen will happen in the next fortnight.

For the quarter ended September 30, the promoter stake in Kotak bank stood at a little over 30 per cent.

Earlier, the promoters had sought to bring down their stake through the issue of perpetual non-cumulative preference shares (PNCPS). However, this did not find favour with the central bank.

The RBI had said that the stake dilution did not meet its regulatory norms.

It may be noted that the RBI has of late been taking a very strict view on promoter holdings and would be unlikely to yield to any requests for relaxations.

So far, during this calendar year (based on the closing price on Thursday), shares of Kotak Mahindra Bank has risen more than 18 per cent.

Sources said current statutes allow for investment by a foreign entity into a domestic bank.

According to a 2016 RBI notification, a regulated, well diversified and listed/ supranational institution/ public sector undertaking/government can take up to 40 per cent holding in a private sector bank.

There are also precedents where single ownership caps have been relaxed or are much higher like mortgage major HDFC’s 23 per cent holding in HDFC Bank.

Canada-based NRI investor Prem Watsa’s Fairfax Holdings had also recently picked up a 51 per cent stake in Kerala-based Catholic Syrian Bank.

In early August, Uday Kotak had sold part of his stake in the lender and brought down his personal holding to under 20 per cent by issuing these shares.

While the RBI brought these promoter holding rules as it wants diversified ownership in private sector banks, Kotak Mahindra Bank had, however, maintained that the equity dilution through PNCPS met the regulatory requirement.