Kumar Mangalam Birla dropped a bombshell on Friday by asking Kesoram Industries Ltd to take him off the list of promoters, severing a family business connection that dates back to his great grandfather, G.D. Birla.

In a letter sent to the Kesoram company secretary, Birla said he held only 300 shares in his own name in the company and, therefore, pressed for reclassification of his and his family’s stake in the company.

“Neither do I or my family or entities controlled by me or my family hold substantial (more than 10 per cent) number of shares in these companies,” Kumar Birla said.

Birla buttressed his argument for stake reclassification by saying that a promoter’s tag brought with it certain “compliance problems”.

He illustrated this point by drawing attention to the show-cause notice that the Competition Commission of India had sent to UltraTech, when it bid to acquire Jaypee Cement plants, for failing to declare that Century and Kesoram were jointly managed by the Aditya Birla group which he heads.

He said there were even greater “compliance complications” that could arise from recent changes in the Companies Act, Sebi (Issue of Capital and Disclosure Requirements) Regulation 2018, and the Insolvency and Bankruptcy Code (IBC).

Kesoram Industries started operations as Kesoram Cotton Mills in 1919.

Will he, won’t he

It wasn’t immediately clear how the latest demand by Kumar Birla would complicate matters relating to Kesoram and Century Textile — both are controlled by Basant Kumar Birla, Kumar’s grandfather.

BK Babu, who will turn 100 next January, had often said in the past that the two companies would eventually pass to Kumar but that hasn’t happened. He later altered the position to say that his younger daughter, Manjushree Khaitan, would manage Kesoram which earns the majority of its revenues from its cement and tyre businesses, with active assistance from Kumar.

After the ascension of Khaitan, Kumar’s aunt, as the vice-chairperson of the company in 2013, the affairs of the crown jewel of BK Birla Group have remained under her control even though some shareholders have made sporadic demands that Kumar should manage the firm.

“I do not exercise any management or other control, directly or indirectly, in Kesoram Industries or enjoy any special right of any kind therein,” Kumar’s letter says.

Kumar joined the board of Century Textile in 2006 and became vice-chairman in 2015.

Stock price

Stock market participants and Kesoram shareholders said the announcement, which came after market hours on Friday, could weigh on the stock. The announcement comes at a time Kesoram is trying to deal with continuous losses, mainly owing to its under-performing tyre business. On December 4 last year, the company proposed a mirror demerger of the tyre and cement divisions. The process is still on.

The ongoing losses and massive debt of around Rs 3,400 crore (as on September 30, 2018) have raised doubt about whether the company will be able to pay the lenders in time or be pushed into insolvency in the future.

The IBC bars the promoters of companies facing corporate insolvency resolution process from submitting bids for other companies until they clear overdue loan amounts. For instance, ArcelorMittal had to clear dues worth Rs 7,000 crore in two companies where he was listed as a promoter before the Lakshmi Mittal-owned company was declared eligible to bid for Essar Steel.

Given that Aditya Birla Group is participating in bidding for bankrupt firms — it bought over Binani Cement last year from insolvency courts — some investors wondered if Kumar was trying to distance himself from Kesoram in abundant caution to avoid any sticky situation like the Mittals faced. Sources said Kesoram was meeting the debt obligations of both financial and operational creditors.

Crossholding

Kumar’s sudden request also focuses the spotlight on the crossholdings of the extended Birla family, which involves several listed companies that are actively managed by different family members.

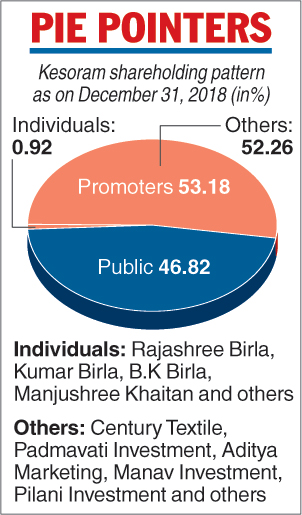

For instance, Pilani Investment and Industries Corporation holds 19.17 per cent in Kesoram and 33.11 per cent in Century Textile & Industries. Pilani is majority held by Aditya Marketing & Manufacturing and Padmavati Investment. These unlisted firms also show up as promoters of Kesoram and Century Textile.

Under the Significant Beneficial Ownership Rules, an individual will have to be declared as SBO if he, directly or indirectly, holds 10 per cent share or exercises significant control or influence. Kumar’s letter to Kesoram indicates he should not be considered as SBO in the company.

“Historically, I have been disclosed as a promoter of Kesoram even though, along with my family and entities controlled by us, (I) hold less than 0.0035 per cent shareholding in Kesoram,” Kumar’s letter said. This translates into 4,991 shares in Kesoram.