The Telegraph

Post merger, Max India will get dissolved without being wound up and subsequently the equity shares of the merged entity will get listed on both the BSE and the NSE, the statement said.

“The newly listed combined entity of Max Healthcare and Radiant with an equity valuation of Rs 7,242 crore will be promoted by Abhay Soi and co-promoted by global investment firm KKR,” it added.

Commenting on the development, Radiant chairman and MD Abhay Soi said, “Radiant has achieved significant growth and expansion during a time of rapid industry consolidation, and the proposed acquisition of a majority stake in Max Healthcare marks an exciting step forward in our strategy to increase scale by merging with a leading and complementary hospital network.”

Expressing similar views, KKR India member & CEO Sanjay Nayar said: “We are excited to back Radiant’s efforts towards consolidation in the healthcare sector by helping them create an effective platform in India for the highest-quality healthcare service providers, best in class infrastructure, practices, doctors and management teams.”

The combined business will enjoy a leadership position among the attractive metros of Delhi and Mumbai, he added.

Max Group founder & chairman emeritus Analjit Singh said: “Both Max and Radiant possess complementary sets of capabilities in running healthcare establishments and KKR brings with it extensive global experience and expertise in healthcare investments as well as capabilities in prudent financial management and efficient capital allocation.”

The merger offers significant growth potential with revenue and cost efficiencies to be extracted, he added.

Based on the share exchange ratio recommended in the valuation report, the resultant shareholding of the combined entity will be 51.9 per cent, 23.2 per cent and 7 per cent held by KKR, Abhay Soi and Max Promoters respectively, with the balance being held by the public and other shareholders, it added.

“The merged entity will continue to use the current brand name Max Healthcare, with appropriate adjustments to its logo,” it added.

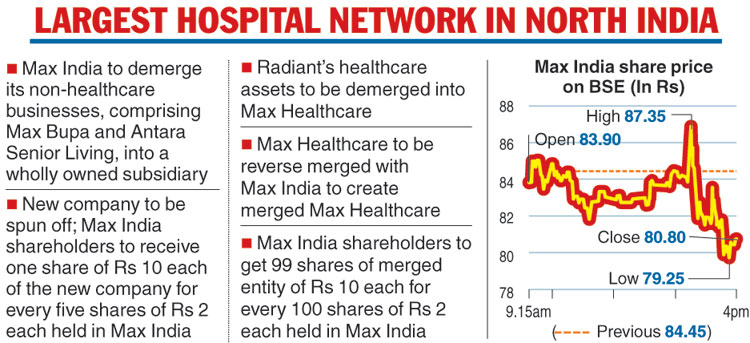

Shares of Max India closed at Rs 80.80 per scrip on the BSE, down 4.32 per cent from its previous close.

Max India, the Analjit Singh-owned healthcare firm, will sell a majority stake in its hospital-operating joint venture to KKR-backed Radiant Life Care Pvt Ltd, resulting in a listed company worth Rs 7,242 crore.

The deal, to be carried out through a series of transactions, will see KKR becoming the majority shareholder, while Radiant Life Care promoter Abhay Soi will lead the combined company as chairman.

Max Healthcare promoters led by Analjit Singh will step down.

“The combination of Radiant and Max Healthcare will create the largest hospital network in north India, which will be among the top three hospital networks in India by revenue and the fourth-largest in India in terms of operating beds,” the companies said in a joint statement.

The merged entity will operate over 3,200 beds throughout 16 hospitals across India, it added.

“The acquisition will be undertaken through a series of transactions, including Radiant’s purchase of a 49.7 per cent stake in Max Healthcare from South Africa-based hospital operator Life Healthcare in an all-cash deal,” it said.

As part of the deal, Max India will demerge its non-healthcare businesses comprising Max Bupa and Antara Senior Living into a new wholly owned subsidiary of Max India whose shares will be listed separately on both the BSE and the NSE.

This new company will be spun off and shareholders of Max India will receive one share of Rs 10 each of the new company for every five shares of Rs 2 each that they hold in existing Max India, it added.

Following the demerger and the spin-off, Radiant’s healthcare assets will be demerged into Max Healthcare which will then undertake a reverse merger with Max India to create a merged Max Healthcare, the statement said.

As a result of the reverse merger, shareholders of Max India will receive 99 shares of the merged entity of Rs 10 each for every 100 shares of Rs 2 each that they hold in Max India, it added.