Just as one man’s paranoia becomes another man’s opportunity, the scare unleashed worldwide by Covid-19 has morphed into a challenge for pharmaceutical companies to concoct a vaccine.

The need for a workable vaccine to repel the evil has, not unexpectedly in an otherwise cheerless market, intensified investors’ interest in pharma stocks, and, by extension, pharma funds.Yes, pharma is suddenly the talk of the town.

Let us take a look at sector funds and the issues you must consider before hitching a ride on this rather risky class of investment vehicles. Let us begin by reminding you that pharma has been a laggard of sorts for more than five years in a row. Its performance, with a few exceptions, has been quite disappointing for many straight quarters.

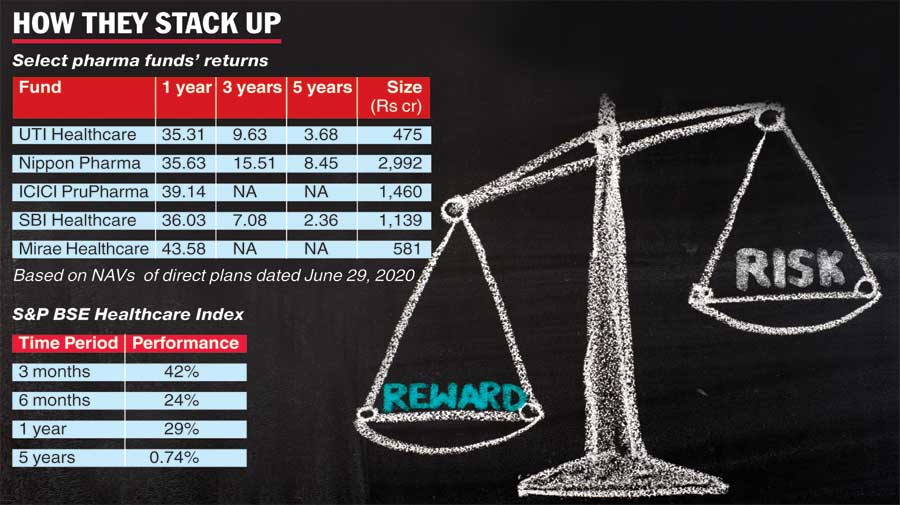

Well, the straggler now seems primed for a push, thanks to the crisis created by Covid-19. Many leading pharma stocks have advanced on the bourses lately, a gain that has significantly enthused those who had made strategic allocations in recent months. Pharma funds are being actively monitored and the recent gains recorded by their NAVs have stoked retail sections of the market. See charts

Caught in a trap?

A sector fund is a specialist — it invests only in stocks picked up from its chosen sector. Examples include funds dedicated to information technology or fast moving consumer goods. These funds do not look beyond their narrow universe. Sector funds, by definition, operate within closed confines. These are, therefore, never too broad-based.

What is sacrificed in the process is diversification across multiple segments of the economy. You cannot really expect a pharma fund to look much beyond drug manufacturing companies. But you can well expect its fund manager to pepper his portfolio from listed diagnostic centres, corporate hospitals, testing laboratories and sundry healthcare players.

The trouble is there aren’t too many listed players in the overall pharma space. Therefore, a narrow spread becomes narrower quite automatically. The range of choices before the fund manager becomes even more compressed. And this is a potential red flag too — the investor must know where the danger lies.

An absence of diversification implies that the investor can be virtually trapped; money cannot move to other areas when the chosen sector declines. Its challenges can be myriad. They may appear in the shape of non-visibility of profits, destruction of value, plummeting volumes, low liquidity and so on.

Not always so

Before you shelve your plan to acquire sector funds, let us remind you that sectoral bias sometimes can be worth the risk too.

An FMCG fund, for instance, is quite likely to turn out a superior performance when the sector surges ahead. In fact, such a fund is expected to do better than its diversified peers which may have done some (but not overwhelming) FMCG allocation over a period of time.

History is replete with examples. The fabled dotcom boom spawned mammoth interest in internet companies, many of which later disappeared without leaving a trace. However, during the overheated phase — it was indeed a bubble — internet funds fetched terrific returns! The fact that those returns did not last beyond a very short stretch of time is another story.

This brings us to the lesson we wish to impart in this context. In fact, there are two very solid lessons to learn. One, sector funds are not really for the long haul. Two, sector funds should not form the core of your portfolio.

The funds we are discussing today will bring in smart numbers (and, therefore, justify their purchase) only when their chosen sectors are delivering outstanding performance. For the rest of the time, especially when these sectors are dwindling, their presence will not merit a second look. Indeed, they can be a serious drag on the investor’s outlay as well.

Moreover, these funds cannot serve as the foundation of your holdings. They can be mere additions and investors should see them as attempts to shore up their overall returns when certain sectors turn up the thermostat.

Some dos

Based on these inferences, here is a set of to-dos for investors

⚫ Create your portfolio by first investing in open-ended, diversified funds that invest in a range of economic segments. Mutual funds allow instant diversification. This is at the core of all benign investing practices. Setting up SIPs can be a good way to commence your journey.

⚫ Once you are sure that you have sufficient diversification, consider themes or sectors as additional purchases. Choose sector funds carefully. When times are promising, these will serve as kickers.

⚫ Revisit your holdings on a regular basis, de-select the funds that you think are a drag on you. Shed the excess baggage (diversified or sectoral, it does not really matter) whenever the need arises.

⚫ Sector funds are tactical buys. So do not hesitate to do a bulk investment (not SIPs) when a particular sector is set to boom. Needless to say, you need to pursue a ruthless exit strategy when “boom” turns into “bust”.

Sector funds are not for the faint-hearted. Remember, when “pump” becomes “slump”, it is time to dump the lot.

The writer is director, Wishlist Capital Advisors