Shares of Jet Airways crashed over 40 per cent on Tuesday after a consortium of lenders led by the State Bank of India (SBI) decided to take the airline to the National Company Law Tribunal (NCLT).

The SBI filed an insolvency plea under Section 7 of the Insolvency & Bankruptcy Code (IBC) at the Mumbai bench of the NCLT on Tuesday. The matter will come up for hearing on Wednesday.

On Monday, the banks had decided to start bankruptcy proceedings against the grounded carrier after their attempts to find a buyer outside the IBC process failed.

The suitors had sought exemption from Sebi’s open offer norms and a steep hair-cut, which was not acceptable to the lenders. However, under the IBC, a successful bidder can be exempted from making an open offer. The airline owes more than Rs 8,000 crore to the lenders.

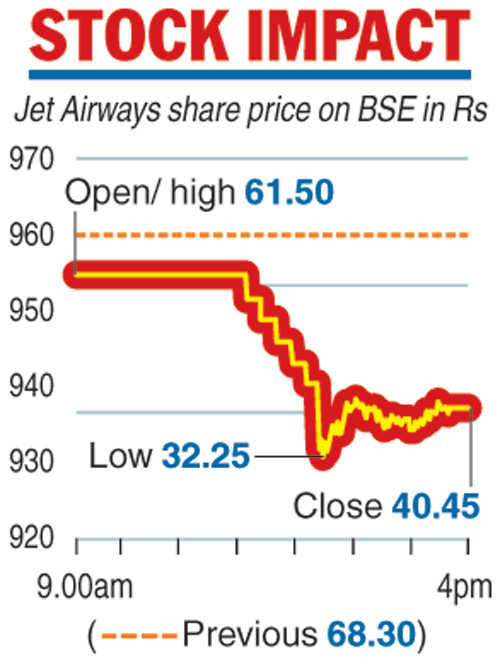

It was a downhill ride for the investors of Jet Airways on the bourses. On the BSE, the stock plummeted 40.78 per cent to close at Rs 40.45. During intra-day trades, it tanked 52.78 per cent to hit an all-time low of Rs 32.25.

The Telegraph

On the NSE, the share dropped 40.78 per cent to close at Rs 40.50. The scrip touched a record intra-day low of Rs 31.65 — a fall 53.72 per cent. On the traded volume front, 60.53 lakh shares were traded on the BSE and over four crore shares on the NSE .

The counter had already taken a beating after the stock exchanges imposed restrictions on trading in the company’s shares, effective June 28, as part of preventive surveillance measures to curb excessive volatility.

The Jet stock has fallen for the 12-day running. During this period, the stock has plunged over 73 per cent, wiping out Rs 1,253.5 crore from its market valuation on the BSE. At the close on Tuesday, the company had a market capitalisation of Rs 459.50 crore.

There was more disappointing news for investors with the company announcing that two independent directors had resigned from the board.

“Ashok Chawla and Sharad Sharma resigned as independent directors with effect from June 17,” Jet Airways said in a filing on the bourses.