The Telegraph

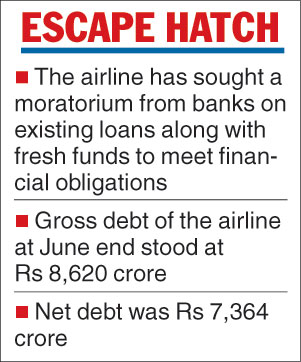

Jet Airways — the country’s second-largest airline — is understood to have asked banks for a moratorium on its loans apart from fresh funds to overcome its financial difficulties.

As on June 30, the gross debt on its balance sheet stood at Rs 8,620 crore, while net debt was placed at Rs 7,364 crore.

A Bloomberg report said Jet Airways has approached banks for a moratorium and has also asked for fresh funds. While the airline is in the midst of implementing a turnaround strategy which includes monetisation of its stake in its loyalty programme, the report said banks have sought more details on its proposal.

“The board-approved turnaround strategy is under implementation. The strategy encompasses various cost-reduction and revenue enhancement initiatives, including working on restructuring our balance sheet via debt-reduction, streamlining cash flows, payroll optimisation, exploring funding options such as capital infusion, monetisation of the company’s stake in its loyalty programme and several other measures to realise higher productivity and operational efficiencies,” a spokesperson for Jet Airways told The Telegraph.

“The airline will make announcements with regard to measures once finalised.”

While Jet Airways continues to be a standard asset in the books of banks, Amit Agarwal, deputy chief executive officer and chief financial officer, had told analysts in a conference after its first-quarter results that close to 65 per cent of its total debt is denominated in US dollars.

He had then disclosed that over the last few years, the airline had been able to bring down its net debt by Rs 3,500 crore, apart from refinancing a portion of the debt at regular intervals.

Jet Airways, which reported a standalone loss of Rs 1,323 crore during the first quarter ended June 30, continues to face headwinds that include firm crude prices and a weaker rupee even as intense competition has restricted it from fully passing on the cost increases through higher fares. In his outlook for the second quarter, Agarwal had said in the August conference call that the aviation market in India continues to be challenging, despite unprecedented growth in passenger numbers and in a challenging environment, the focus remains on “building base loads’’.

Shares of Jet Air ended marginally higher at Rs 212.65 after rising almost 4 per cent.