Lenders led by the State Bank of India (SBI) expect a new investor for Jet Airways to be in place by the end of May or early June after Naresh Goyal stepped down from the airline’s board on Monday as part of a resolution plan designed to bring the airline out of a crisis.

The bidding process to bring in the investor will start next month. Goyal may still have a chance to get back the airline he founded as SBI chief Rajnish Kumar told a news channel that the founder or even Etihad would not be barred from the auction. The stake purchase will be governed by the rules of the ministry of civil aviation and other regulators such as Sebi.

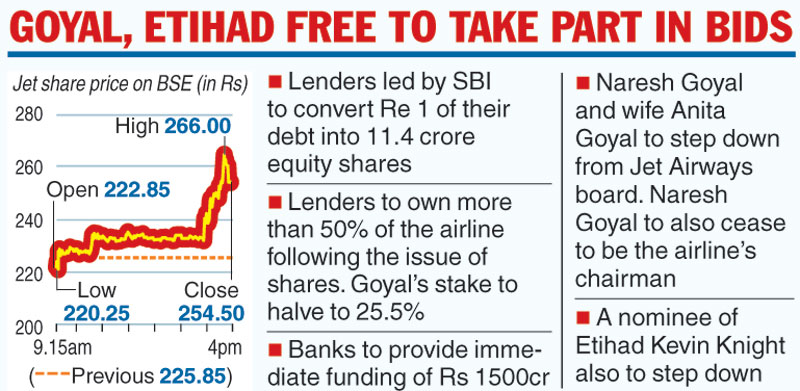

A consortium of banks that included India’s largest lender SBI have agreed to immediately infuse Rs 1,500 crore in the company. They will acquire a little over 50 per cent stake in Jet through the issue of 11.4 crore fresh shares. This issue will halve the promoter’s stake to 25.5 per cent, while Eithad’s holding will come down to 12 per cent.

Two nominees of the promoter —Goyal and his wife Anita — on Monday stepped down from the board. While Naresh Goyal ceased to be the chairman, another Etihad nominee stepped down from the board.

In a letter to Jet staff, Naresh Goyal wrote on Monday: “I would be lying, if I said this was not an emotional moment for us... there is no sacrifice both Anita and I would not make to ensure the best interests of our Jet Airways family are safely secured.

“We have not come to this decision lightly but this is not the end of the journey, rather it is the start of a brand new chapter. I am stepping down as the chairman of the board, but both Anita and I remain committed to seeing Jet Airways embark on a dynamic new chapter.”

The Telegraph

The process

A Jet statement said the lenders would initiate the bidding process for the sale or the issue of shares to a new investor. The process is expected to be completed in the June quarter. However, the SBI chairman felt it should be over by May.

Interested parties will have to submit their expression of interest by April 9. Binding bids will have to be given by April 30.

Apart from the players who will put in their bids, the focus will be on the price (including debt) they will offer, since it will determine the hair cut that the banks may have to take.

At the current market price, the value of the lenders’ stake in Jet Airways is over Rs 1,400 crore.

The airline has a debt burden of over Rs 8,000 crore. Market circles, however, expect a good response to the auction from both financial and strategic investors, including airlines.

According to Icra, Jet Airways has to pay Rs 1,700 crore to lenders over December 2018 to March 2019. It has to pay Rs 2,444.5 crore in the next fiscal and Rs 2,167.9 crore the following year.

Meanwhile, finance minister Arun Jaitley on Monday said he was happy with the lenders’ decision regarding Jet Airways as the public sector banks had kept legitimate self-interest and public-interest in mind.