Stock impact

The Jet stock may crash on Thursday because of its decision to suspend operations temporarily.

However, this may not be the case with its two listed rivals — SpiceJet and IndiGo — who are expected to gain on the back of the expansion of fleet and announcement of new destinations.

The markets were closed for trading on Wednesday on account of Mahavir Jayanti

“The temporary shutdown was largely factored in by the markets. Yet there could be a knee-jerk reaction and the stock could open sharply lower,’’ an analyst said.

He added the attention would now turn towards the progress made in the selection of the bidder.

However, it could be a different story at the SpiceJet counter as its shares could again see some buying. The scrip had zoomed 11.19 per cent to close at Rs 132.70 on Wednesday.

Likewise, the shares of InterGlobe Aviation, the owner of Indigo, had advanced 7.35 per cent to Rs 1,583.15 at the close of trade.

SpiceJet had earlier announced that it will launch direct flights from Mumbai to seven international destinations, including Colombo, Jeddah, Dhaka, Riyadh and Hong Kong, apart from inducting 16 Boeing 737-800 NG aircraft. Over the past four trading session, the counter has gained over 40 per cent. The carrier has also said it plans to expand its regional jet fleet to 32 aircraft by adding five more 90-seater Bombardier Q400s

The collapse of Jet Airways, had resulted in huge surge in air fares besides mismatch in demand and supply amid peak travel season.

``Despite the fourth quarter of 2018-19 being seasonally weak, we expect profits to remain on an upward trajectory at both Indigo and SpiceJet. Jet Airways should continue to face elevated losses as its PAX decline would overwhelm higher yields’’, a report from Edelweiss Securities said.

Recently, the banks gave interested parties an option to take ownership of the company and bring about a change in control and management or restructure the airline’s existing debt facilities and infuse funds through loans apart from acquiring up to 75 per cent of its equity share capital. This flexibility was not given in the first EoI document put out by the banks.

The jury is still out on whether the lenders should have thrown the lifeline of Rs 400 crore to rescue Jet Airways as banks brace for a discouraging outcome of the bidding process.

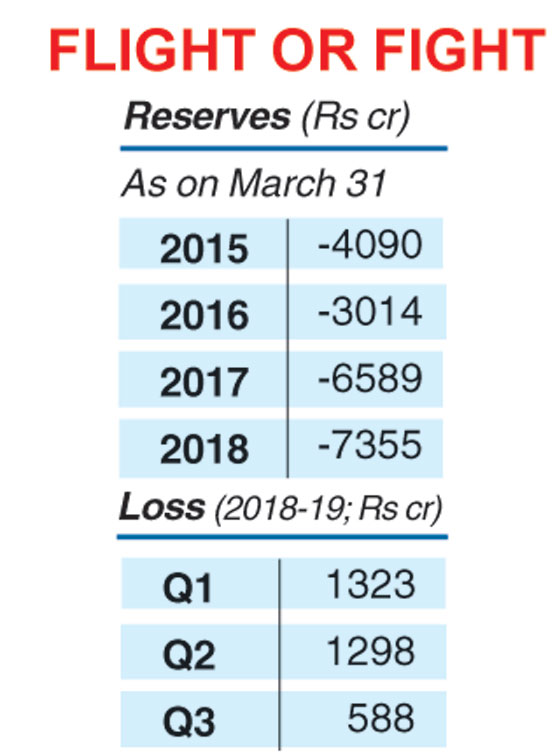

Experts do not rule out the possibility of the aspirants putting in extremely conservative bids considering the present state of the airline. This may see the banks taking a large loss on their exposure to Jet Airways. The grounded carrier owes close to Rs 8,000 crore to the lenders.

All eyes will, therefore, be focused on the bids put in by the four players in the fray — Etihad, National Investment and Infrastructure Fund (NIIF), IndiGo Partners and TPG Capital.

Jet Airways on Wednesday said in a statement which announced the temporary suspension of flight operations that it will await the bid finalisation process by the State Bank of India and the consortium of domestic lenders.

Jet said banks had informed the airline that expressions of interest (EoI) have been received and bid documents issued to the eligible recipients on Wednesday.

“The bid documents inter alia have solicited plans for a quick revival of the company. The bid process will conclude on May 10 … We are actively working to try and ensure that the bid process leads to a viable solution for the company,’’ it added.

Interim funding or not, the loss to banks would depend upon the enterprise value put in by the bidders, a senior banker associated with the exercise said. Enterprise value of a company is market capitalisation along with its debt.

“When bids are being invited and evaluated, an airline which is running will always be preferred than an airline with standstill operations... If the lenders are close to finding an investor for Jet Airways, perhaps they could have put in some money to keep the operations running at least on a small scale,’’ Jitendra Bhargava, former executive director at Air India and aviation expert, told The Telegraph.

Market circles fear with more employees likely to leave Jet Airways after the temporary shutdown and the carrier losing landing slots, the valuation put in by the interested parties could suffer.

“It will be a tall order for the winner to bring the airline back to operations,” Shriram Subramanian, founder and managing director of InGovern Research, a proxy advisory firm, said.

The government has already provided some of the unused slots of Jet Airways to other airlines.

The Telegraph