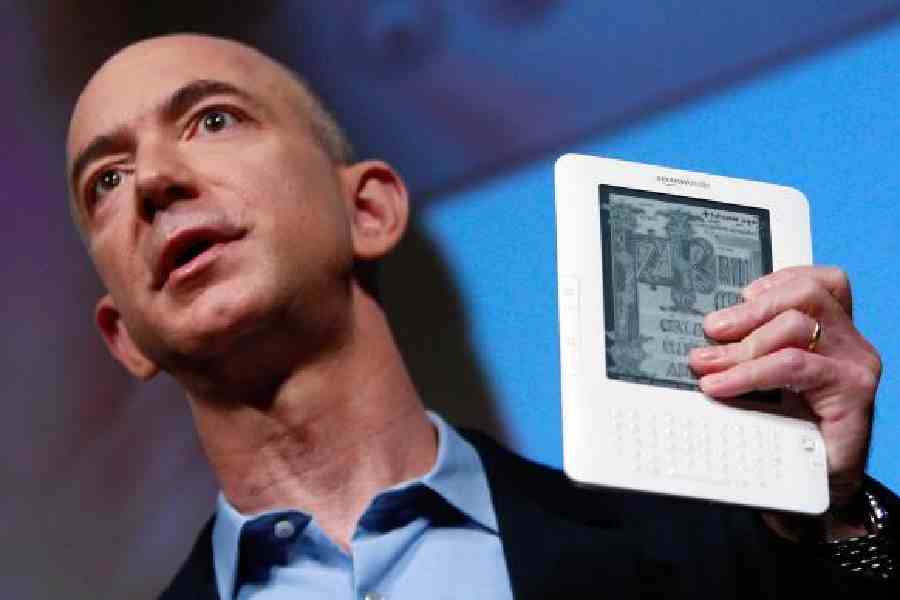

Jeff Bezos filed a statement with federal regulators indicating his sale of nearly 12 million shares of Amazon stock worth more than $2 billion.

The Amazon executive chairman notified the US Securities and Exchange Commission of the sale of 11,997,698 shares of common stock on February 7 and February 8.

The collective value of the shares of Amazon, which is based in Seattle where he founded the company in a garage about three decades ago, was more than $2.04 billion, according to the listed price totals.

The stocks were grouped in five blocks between 1 million and more than 3.2 million.

In a separate SEC filing, Bezos listed the proposed sale of 50 million Amazon shares around February 7 with an estimated market value of $8.4 billion.

Bezos stepped down as Amazon's CEO in 2021 to spend more time on his other projects, including the rocket company, Blue Origin, and his philanthropy. His address on the stock filings is listed as Seattle, although he reportedly has relocated to Miami.

The sale plan, which is subject to certain conditions, was adopted on November 8 last year and will be completed by January 31, 2025, according to the company's latest annual report.

He is currently the world's third richest person with a net worth of $200 billion, according to Bloomberg Billionaires Index.

Legal suit

Amazon.com was sued in a proposed US class action accusing the online retailer of violating a consumer protection law by steering hundreds of millions of shoppers to higher-priced items to earn extra fees.

According to a complaint filed on Thursday in federal court in Seattle, Amazon's algorithm for choosing what to display in its "Buy Box" when shoppers search for products often obscures lower-priced options with faster delivery times.

Amazon allegedly created the algorithm to benefit third-party sellers that participate in its Fulfillment By Amazon program and pay "hefty fees" for inventory storage, packing and shipping, returns and other services.

Amazon declined to comment. The complaint was filed by California residents Jeffrey Taylor and Robert Selway.

AP & Reuters