The race for the acquisition of Reliance Capital’s 51 per cent stake in Reliance Nippon Life Insurance Co (RNLIC) is intensifying, with the top brass of the Japanese partner in the joint venture likely to visit India this week to flag its concerns with the resolution process under insolvency laws, sources said.

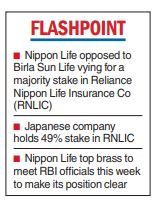

Japan’s Nippon Life, which holds a 49 per cent stake in RNLIC, is opposed to the entry of Aditya Birla Sun Life in the race to acquire Reliance Capital’s stake in RNLIC.

Sources said Nippon Life’s global president Hiroshi Shimizu along with Minoru Kimura, managing executive officer and head of global business, Nippon Life Insurance, and Tomohiro Yao, regional CEO, Nippon Life Asia Pacific and director, RNLIC, are likely to visit Mumbai on Monday.

Shimizu and his team may meet senior officials of the Reserve Bank of India (RBI) and other stakeholders, and apprise them of their position with regard to their investment in RNLIC and their longterm commitment to the Indian insurance sector.

The visit coincides with the deadline for submitting the final binding bids for Reliance Capital and its subsidiaries, including RNLIC.

Sources said Nippon Life has already made it clear to Y. Nageshwar Rao, the insolvency administrator of Reliance Capital, that the company is opposed to the entry of Aditya Birla Sun Life in the bidding process of RNLIC.

It does not want to merge with Birla Sun Life or sell its 49 per cent stake in the Indian outfit, sources said.