Japan-based Softbank has started the process to sell a 4.5 per cent stake in One97 Communications — the parent of Paytm —for about $200 million (around Rs 1,627 crore) in a block deal, according to sources.

The shares will be sold at a massive discount of around 70 per cent to the Paytm IPO price, a sign of massive wealth erosion the new-age tech firms have inflicted on investors amid fears that worse may follow for the stock.

The development comes immediately after the lock-in period for Paytm’s investors to trade shares ended.

The stocks of FSN e-Commerce Ltd, the owner of fashion retailer Nykaa, have also continued to plummet a year after the lock-in of pre-IPO investor stake was lifted – and the slide hasn’t been halted even after the firm issued a 5:1 bonus to shareholders who bought the shares in last year’s IPO.

Softbank is the second largest shareholder with a 17.5 per cent stake in One97 Communications.

According to two sources aware of the development, Softbank has offered to sell shares in the price band of Rs 555 to Rs 601.55 apiece that are held through its subsidiary SVF India Holdings.

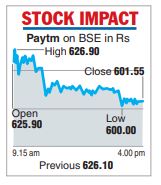

Softbank expects to raise around $200 million at the lower end of the price band, which is Rs 555. Paytm shares closed at Rs 601.55 on the BSE on Wednesday.

The deal may fetch Softbank around $215 million at the upper end. Softbank had invested $1.6 billion in Paytm in the last quarter of 2017 and offloaded shares worth $220 million at the time of IPO.

The current holding of Softbank at closing price is valued at around $835 million.

“If we add $220 million that Softbank raised from selling stock at the time of Paytm IPO then about one-third of the investment that it made in One97 Communications has eroded,” the source said.

Bank of America is the sole book runner for the deal.

Even as Paytm shares could come under pressure, another new-age company that has traded in the red is FSN E-Commerce. The Nykaa parent listed more than 237 crore of bonus shares on the bourses.

For FSN, the weakness comes after the lock-in period for its pre-IPO investors ended on November 10.

The share on Wednesday closed 3.91 per cent or Rs 7.50 lower at Rs 184.50 on the BSE — a fall of nearly 9 per cent over its previous close.