Top officials at ITC have mounted a sharp defence of the move to demerge the hotel business from the Rs 72,000 crore tobacco-to-hotels conglomerate, arguing that the spinoff promises to bring big benefits to the parent as well as the new entity.

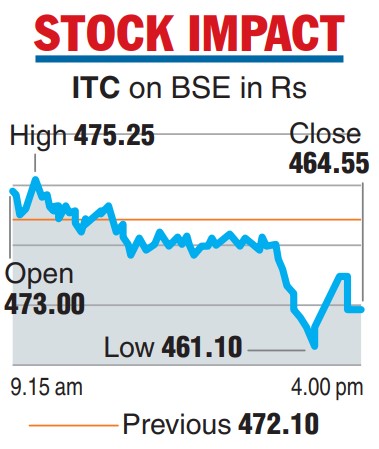

Investors have clobbered the ITC stock ever since the tobacco giant sprang the demerger plan on the markets last Monday — an unexpected development that bemused the bigwigs at Chowringhee’s Virginia House.

In an uncharacteristic move, ITC’s top brass decided to hold a conference with a bunch of analysts where they justified the demerger plan whose final contours will be etched at a board meeting on August 14.

In an effort to soothe the jangled nerves of investors, they said the return on capital employed (RoCE) and the return on invested capital (RoIC) — two key metrics used by investors to measure profitability and capital efficiency at an enterprise — would significantly brighten at ITC after the demerger of the asset-heavy hotel business.

The resultant company, to be tentatively called ITC Hotels Ltd, will also find itself on firm footing because of a large asset base, zero debt and free cash flows — a rich amalgam that will create the headroom for growth, the conglomerate’s top executives said.

“The whole objective is to ensure that the new entity grows faster than the past…from an ITC perspective, the return ratios would improve immensely, reinforcing our stand on sharper capital allocation strategy,” ITC chairman Sanjiv Puri said during the 90-minute long investor call on Thursday afternoon.

Instead of going for a mirror image demerger, ITC is pursuing a different structure, holding a 40 per cent stake in the resultant company directly, while distributing the balance 60 per cent stake in the new entity among ITC’s existing shareholders on a proportionate basis.

Some of the investors and analysts questioned the rationale of holding a relatively large stake, which would potentially limit shareholders’ ability to unlock value by cashing out. The stock has corrected 7 per cent from the peak reached just before the announcement was made on Monday market hours.

The ITC management presented a cogent argument to defend the structure arguing that it would ensure that the new company would continue to access the goodwill and brand assets of ITC and harness institutional synergies.

A 40 per cent stake will also give the new entity a chance to bring in an employee stock option scheme, which dilutes shareholding over some time, and the headroom to take strategic decisions, if the opportunity arises. Puri underlined that hospitality remains a people-centric business and the new structure will ensure continuity for the employees working in the division.

Return ratios

Supratim Dutta, executive director and CFO, who was present in the call, explained that ITC Hotels will be an associate company of ITC and it would reflect in the consolidated balance sheet of the parent.

RoCE would go up by 18-20 per cent while RoIC may inch up by 10 per cent, post the demerger, based on FY23 results, Datta added. He also informed that ITC Hotels would have about Rs 6,000 crore of net assets, no debt and strong cash flow to support.

The CFO also assuredthe investors that the demerger process would be taxneutral from the income tax point of view and the incidence of stamp duty arising out of the transactionswould be marginal.

Asset right

The company management does not foresee a large capital requirement for the hotel business as it would continue with the strategy to take up new properties under management contracts rather than building new ones.

However, Puri clarified the strong balance sheet of the new hotel would allow it to pursue strategic initiatives or ‘‘trophy assets’’ if they come in the way. It can raise both debt and equity depending on the requirement.

The management also informed that ITC does not have any arrangement with any large shareholders to buy their shares should they offload stake from the hotel entity, post demerger. It was also indicated that ITC would remain invested in ITC Hotels.