ITC has dragged beleaguered hotelier The Leela into several fora, including company law court and stock market regulator Sebi, by filing multiple cases, alleging oppression and mismanagement against minority shareholders.

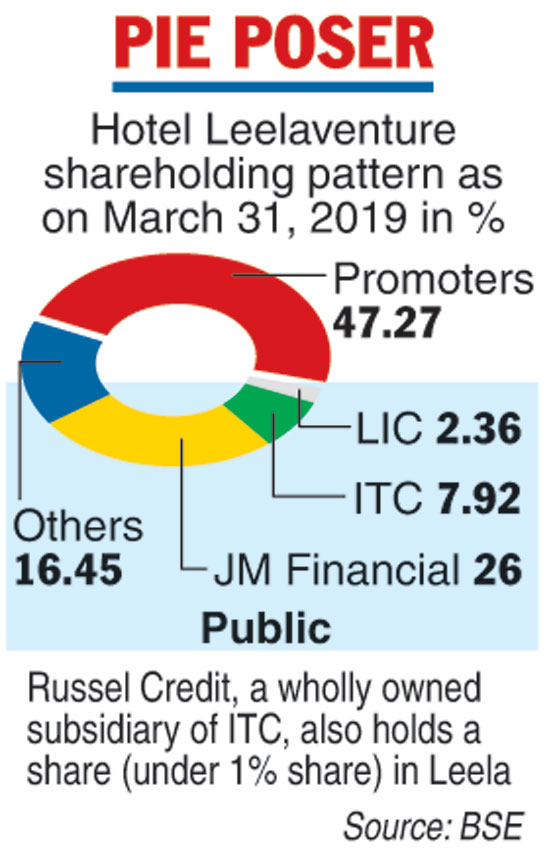

The conglomerate, which checked into Hotel Leelaventure through a creeping acquisition of shares 10 years back, owns a 7.92 per cent stake as on March 31, 2019.

Russel Credit, a wholly owned subsidiary of ITC, also holds a share (under 1 per cent) in Leela. ITC itself is a major player in the hotel industry.

ITC’s plea will be heard by Justice V.P. Singh and Ravikumar Duraisamy at the National Company Law Tribunal, Mumbai on April 24, after the company’s advocate sought an urgent hearing on the matter.

Corporate sources said ITC’s objection stems from a deal the Nairs, the promoters of The Leela, signed with global private equity firm Brookfield, to hive off hotels in Delhi, Bangalore, Chennai and Udaipur for Rs 3,950 crore.

The Telegraph

The company plans to use a majority of the proceeds from the sale to repay debt to JM Financial and Asset Reconstruction Company Ltd, which is also a significant public shareholder of Leela, having a 26 per cent stake.

JM cornered the share by converting some of the debt Leela owed to it into equity.

Sources said ITC would be calling the Brookfield deal a “related party transaction” since a significant shareholder (JM) would benefit from the deal and the rest of the minority shareholders, such as ITC, will get zilch.

If the Brookfield deal goes through, Hotel Leela (and its shareholders) would be left with only the Mumbai hotel, a certain land parcel in Hyderabad and a residential development in Bangalore with Prestige Developers.

When contacted an ITC spokesperson said: “The matter is subjudice and, therefore, we would not like to comment.”

A filing made by Leela to the bourses, where ITC has also filed complaints, read: “ITC has on April 22, 2019 filed against the company, a petition for oppression and mismanagement along with two applications for urgent hearing.

“ITC, through their advocates, on Tuesday mentioned the matter before the NCLT, Mumbai bench with diary number: 2709138017852019. The learned bench has placed the said applications for hearing tomorrow.”

The Calcutta-based company is also seeking a waiver from the company law rule on 10 per cent threshold for filing a case for oppression and mismanagement and hoping that a precedence set by the National Company Law Appellate Tribunal would come to its aid.

According to Section 244 of the Companies Act, only two categories of shareholders can file the case under Section 241: Minimum one hundred members or one-tenth of the total number of its members, whichever is less, or, any member or members (jointly) holding not less than one tenth of the issued share capital.