The writer is director, Wishlist Capital Advisors

The Telegraph

A round of defaults, the impact of which is now threatening to engulf a larger swathe of the debt market, has turned investors’ attention squarely towards credit risk, the latter being perceived as a factor capable of causing more damage than any other.

Certain categories of debt funds seem to be particularly vulnerable in this scenario. Is my debt fund imperiled too? Quite naturally, this question has been doing the rounds in market circles and we will try to find an answer here.

Root of the problem

At the centre of all potential trouble is the quality of credit — not every security that has been subscribed to by investors is worth the effort. The presence of weak assets in a portfolio can spell disaster and this is what the investment community is worried about. The existence of blighted infrastructure giant IL&FS and some of its associates that have recently fallen from grace in a range of portfolios was bad enough. The possibility of other defaults will make matters worse.

Let’s push the issue a bit further and explore the idea of credit risk, particularly with reference to debt funds. This arises when a borrower is unable to make payments — such payments typically relate to interest and principal.

Failure to meet obligations upsets cash flows, often leading to large-scale losses for the lender, that is, the holder of the security concerned.

In real terms, this inability can create serious disruptions in the market. In the past, there have been countless cases of such disruptive developments, some of which have had a crippling impact on the entire debt market.

The IL&FS example, for instance, will go down in the history books as one of the most ruinous cases of its kind.

Let’s now turn our attention to debt funds and the steps one need to take in order to stay safe and secure. The first step involves a careful scan of your debt holdings in which investments have been made. This will reveal the presence of rogue issuers, the ones that have already made the kind of news headlines that are best avoided.

The next step, and this is a bit more elaborate, is to consider the credit ratings of the securities. Ratings, as you will no doubt agree, are extremely crucial indicators for investors.

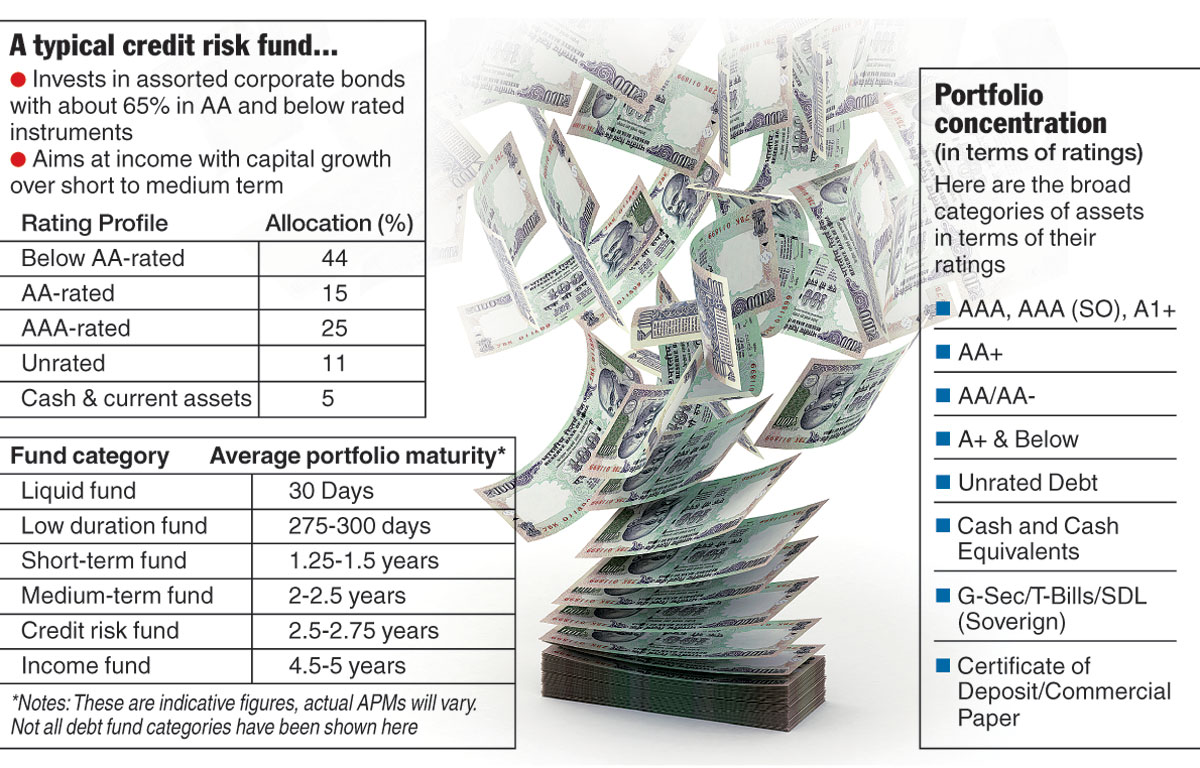

A fund’s rating profile is revealed on a regular basis by the asset management company in its published statements and the latter are easily accessible by all. A typical debt fund seeks to meet its investment objective by allocating primarily to a well-chosen universe of securities within its risk grade.

Match your horizon

Ideally speaking, your exposure to various categories of debt assets should be determined by your time horizon. No prudent investor will allocate short-term money to longer duration funds.

For instance, money that should stay invested for, say two months, should never be directed towards a medium-term debt fund. Instead, a decently performing liquid fund should be chosen.

It goes without saying, therefore, that investors should take a close look at a fund’s average portfolio maturity (APM) to arrive at a logical conclusion on this front.

APMs would differ vastly considering the range of debt funds we now have at our disposal, offered by an asset management industry that is eager to provide a full gamut of products.

A liquid fund can have an APM of 30 days or so, while the same can stand at 2.75-3 years in the case of a credit risk fund. This can go up to five years for a normal income fund. It is for the investor to choose what is best for him — such choice would be determined by his investment objective, time horizon and risk appetite.

Check duration too

A diligent investor needs to keep an eye on the duration profiles of debt funds before he exercises choice. In particular, he must check what is known as the “Macaulay Duration”, a concept named after its developer Frederick Macaulay. This is defined as the weighted average time to full recovery of principal and interest payments of a bond.

In other words, here we are referring to the weighted average maturity of cash flows. The weight of each cash flow is arrived at by dividing the present value of the cash flow by the price of the bond. Accessing a fund’s duration profile is easy enough; the asset management company concerned regularly provides it in its factsheets.

A debt fund investor should also be vigilant about portfolio concentration. “Has my fund invested in well-rated securities?” An affirmative answer to this question will undoubtedly boost his confidence.

Inadequate ratings are indicative of risk and the presence of too many poorly rated securities in a portfolio should be specifically flagged.

At the end of the day, an investor’s returns will be determined by a combination of so many disparate factors. His choices should, therefore, encompass the finer aspects of these factors. He would do well if he consults an investment professional, especially if he doubts whether a fund is suitable for him or not.