A selling wave swept through Adani group shares on Thursday following the US bribery allegations as group stocks tanked up to 20 per cent, while ₹2.19 lakh crore of investor wealth went up in smoke.

Apprehensions about the Adani stocks spread to banking and LIC shares, and mutual funds — even engulfing key investor GQG in Australia.

GQG Partners took an ambitious bet on Adani firms after the Hindenburg allegations and proceeded to ramp up its stakes.

GQG shares, listed on the Australian Stock Exchange (ASX), tumbled more than 19 per cent.

“We are monitoring the charges brought today. Our team is reviewing the emerging details and determining what, if any, actions for our portfolios are appropriate,’’ GQG said in a filing to the ASX.

“We note that consistent with our portfolio construction guidelines, GQG portfolios make diversified investments, and in aggregate, in excess of 90 per cent of our clients’ assets are invested in issuers unrelated to the Adani group,’’ it added.

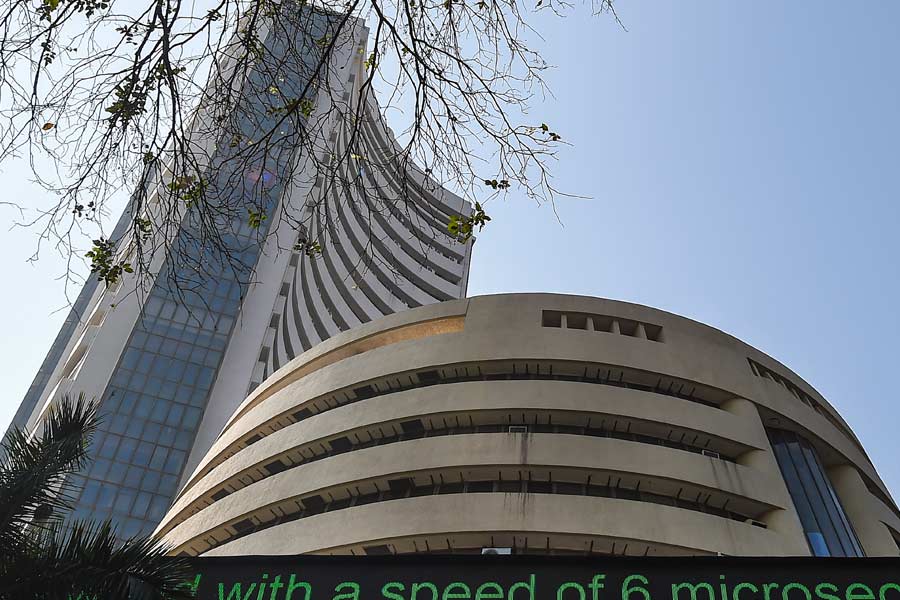

On the BSE, shares of Adani Enterprises plunged 22.61 per cent, while Adani Energy Solutions lost 20 per cent and Adani Green Energy tanked 18.80 per cent.

Among others, while Adani Ports crashed 13.53 per cent, Ambuja Cements took a knock of 11.98 per cent, while Adani Total Gas fell 10.40 per cent.

Among other stocks, Adani Wilmar declined 9.98 per cent, Adani Power by 9.15 per cent even as ACC dropped 7.29 per cent and NDTV by 0.06 per cent.

“While the market is in the midst of a bear hug for the past few weeks, today’s fall can also be attributed to the news of Adani group facing bribery charges, which triggered a massive sell-off in its group stocks,” Prashanth Tapse, senior VP (research), Mehta Equities Ltd, said.

Mutual funds that have an exposure to the group could feel the heat. Among fund houses, Quant Mutual Fund had the highest exposure to its stocks. According to Prime Database, it held almost ₹4,900 crore of Adani stocks as of October end.

Banking stocks, particularly those which had lent to the group, got caught in the selling whirlwind. State Bank of India for instance lost 2.64 per cent, while the shares of Bank of Baroda (BoB) fell 3.63 per cent and Punjab National Bank cracked 4.48 per cent.

It is believed that these three PSU banks have a combined exposure of around ₹39,000 crore to the Adani group. LIC took a notional hit of over ₹8,200 crore in seven group companies.

Bonds of the group traded overseas also faced sell-off.

A Reuters report said the Adani Ports bond maturing in August 2027 fell more than five cents on the dollar according to LSEG data.

The other debt that declined included that of Adani Electricity Mumbai and Adani Transmission. Incidentally, the decline was more than that seen after the Hindenburg report.