Investor nerves were taut on Thursday on the eve of the monetary policy announcement by the Reserve Bank of India.

The release of the minutes of the last meeting of the US Federal Reserve added to the anxiety of investors as the Sensex plummeted over 575 points and the yields on the benchmark 10-year-paper remained above 6.90 per cent.

Fed struck a very hawkish note in the minutes, deciding to reduce its bond holdings by $95 billion a month while considering rate increases to the extent of 50 basis points to quell inflation running at a four-decade high in the US.

The minutes had led to a sell-off in global equity markets with the Dow Jones Industrial Average slipping almost 145 points and the tech-heavy Nasdaq over 315 points.

On Thursday, most of the Asian markets traded in the red with benchmark indices slipping up to 2 per cent.

In India, the Zee counter came under selling pressure as its largest investor Invesco sold around 7.8 per cent shares through block deals.

Data on the BSE showed the US fund selling 7.4 crore shares of Zee at Rs 281.46 apiece worth nearly Rs 2,092 crore. The shares of the media firm ended lower by 2.10 per cent at Rs 284.85 on account of the block deal.

Investors are tuned in to the RBI’s revised growth and inflation forecast on Friday. Economists are expecting a sharp hike in its inflation projection.

Brokerage Emkay Global said it expected the rates and the RBI stance to remain unchanged. But the forecast for inflation may be raised 50-75 basis points from 4.5 per cent.

The brokerage said the RBI may slightly lower its growth forecast by 30-35 basis points from 7.8 per cent. The bond markets are already worried about rising inflation in addition to the record supply of government paper this fiscal.

On Thursday, the yields on the benchmark 10-year paper remained above 6.90 per cent and settled at 6.91 per cent as the market preferred to wait for the RBI announcement. The expectation is some support from the RBI in the form of open market operations or the purchase of bonds.

The 30-share Sensex on Thursday ended at 59034.95 — a fall of 575.46 points after tumbling over 633 points to hit an intra-day low of 58977.35.

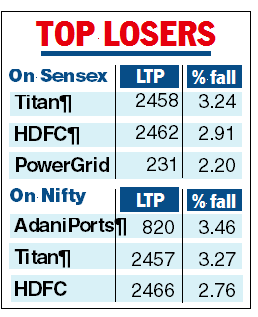

Titan led the list of losers with its share cracking 3.24 per cent as investors expressed their disappointment over its business data for the January-March period. It was followed by the HDFC twins, PowerGrid, Wipro, TCS and Reliance Industries. The broader Nifty-50 declined 168.10 points or 0.94 per cent to close at 17639.55.

According to Deepak Jasani, head of retail research at HDFC Securities, the markets are led by the non-institutional players who have begun to aggressively take profits in the face of balance sheet reduction by the US Fed ahead of the RBI policy meet.

Vinod Nair, head of research at Geojit Financial, said stocks will trade positively if the RBI announcements are in line with market expectations.

Kotak Securities said it expects net profits of the BSE-30 Index to increase 26 per cent year-on-year and 7 per cent quarter-on-quarter and for the Nifty-50 Index to increase 27 per cent year-on-year and 12 per cent quarterly.

The brokerage said it expects bank and oil companies to report strong results.

"We expect negative-to-single-digit annual PAT growth for automobiles, construction materials, consumer staples, metals & mining and pharmaceuticals sectors,” the report added.