Invesco Developing Markets Fund (Invesco), has dropped its plans to call an extraordinary general meeting of shareholders to vote on resolutions seeking to topple Punit Goenka, managing director of Zee Entertainment Enterprises Ltd (ZEEL), and recast its board of directors.

The sudden move removes a major hurdle to Zee’s plans to forge a merger with Sony and comes just days after a division bench of the Bombay High Court permitted it to requisition an EGM – a demand it has made since September last year.

The foreign portfolio investor – which embarked on an aggressive plan to oust Goenka and his cohorts on the ZEEL board – said in a statement issued early on Thursday morning that it would back the plan to merge Sony and ZEEL while contending that the deal had “great potential for Zee shareholders”.

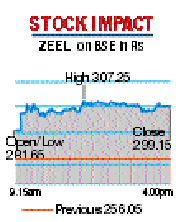

The volte face by Invesco, which holds close to 18 per cent in ZEEL along with its associate OFI Global China Fund, sparked a rally in the ZEEL stock which zoomed nearly 17 per cent, or Rs 43.10, in an otherwise volatile market before closing at Rs 299.15 on the Bombay Stock Exchange.

“The board of the newly combined company will be substantially reconstituted, which will achieve our objective of strengthening board oversight of the company…Given these developments, and our desire to facilitate the transaction, we have decided not to pursue the EGM as per our requisition dated September 11, 2021,’’ Invesco said.

However, Invesco, which ranks as the single biggest investor in ZEEL, said it would continue to monitor the progress of the proposed merger.

“If the merger is not completed as currently proposed, Invesco retains the right to requisition a fresh EGM,” it added.

Last December, ZEEL and Sony Pictures Networks India Pvt Ltd (SPNI) signed definitive agreements for a merger under which they intended to combine their linear networks, digital assets, production operations and programme libraries. Earlier, the two sides had entered a non-binding term sheet in September.

Zee has said the entire merger process is expected to be completed in 8-10 months.

Under the terms of the agreement, Sony Pictures Entertainment Inc (SPE), the parent of SPNI, will indirectly hold a majority 50.86 per cent of the merged entity while the founders of ZEEL will hold 3.99 per cent, and the public shareholders will have 45.15 per cent. There is, however, a proviso to enable ZEEL to raise its stake at a later stage.

Invesco did not reveal why it was keeping the option of seeking an EGM open if the merger with Sony did not work to plan. One analyst said it might withdraw support to the Zee-Sony merger if the terms of the amalgamation differ significantly from what has been announced so far. The merger will need the approval of 75 per cent of the shareholders for it to go through.

Zee said it welcomed Invesco’s decision and acclaimed the US investment firm “for its belief in the true potential of the proposed merger with Sony Pictures Networks India (SPNI) and for its faith in the management’s approach.”

Relations between Invesco and the Goenka family turned frosty in February last year when the US investment fund tried to mediate a takeover of Zee by the Reliance group. Goenka revealed details of the Invesco-Reliance plan only in October last year.