Infosys and HCL Paytm shares Technologies brought smiles back to the IT sector amid a morose outlook as they posted better-than-expected numbers for the third quarter ended December 31. Bangalore-based Infosys went a step further when it raised the revenue guidance for the current fiscal.

The positive report cards of the tech duo removed some of the misgivings about the road ahead for the sector, particularly after TCS came out with tepid numbers for the quarter.

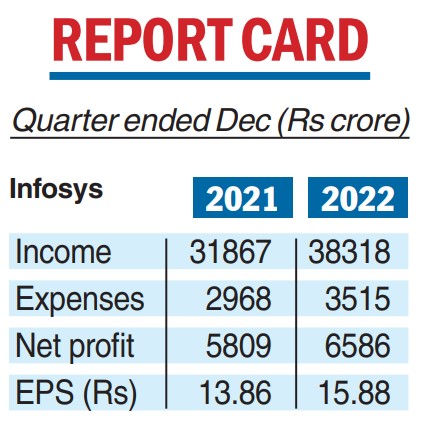

In a seasonally weak period, Infosys reported a 13.4 per cent growth in net profit at Rs 6,586 crore against Rs 5,809 crore in the corresponding period of the previous year. Analysts had projected a net profit of around Rs 6,400 crore for the country’s second-largest IT services firm.

Revenues during the period witnessed a rise of 20.2 per cent at Rs 38,318 crore compared with Rs 31,867 crore in the year-ago period. In dollar terms, it stood at nearly $4.66 billion against $4.25 billion in October-December 2021 — a jump of 9.6 per cent. Brokerages such as Emkay had pencilled in a revenue of $4.59 billion.

A key highlight of the quarterly performance was the large deal wins at $3.3 billion, which was the highest in eight quarters. Infosys won 22 such contracts which were the highest in its history.

This, coupled with a strong revenue growth in the first nine months of the fiscal, led to Infosys raising the revenue guidance for this year.

Most of the analysts had expected that the company will retain its guidance given after the second quarter results were announced.

Infosys now expects its full-year revenue growth to be 16- 16.5 per cent from the earlier 15-16 per cent guidance.

Speaking to the press, Salil Parekh, CEO and MD, Infosys, said while the company continued to take market share during the quarter, most of the industries and geographies grew in double digits in constant currency terms.

He further pointed out that while the deal pipeline remains strong, the digital revenues which rose 22 per cent are now close to 63 per cent of its overall revenues.

According to Parekh, the company is witnessing growth in both areas of digital offerings and core services, which is a testament to its industry-leading digital capabilities.

He admitted that some segments such as mortgages, investment banking, telecom, high-tech and retail are seeing some impact from the global economic slowdown, which is taking a toll on decision-making.

However, he remains confident on the spends made by enterprises in services such as digital and automation.

During the quarter, while operating margins were stable at 21.5 per cent, employee attrition continued to show a declining trend as it fell to 24.3 per cent from 27.1 per cent in the preceding three months.

At the end of the quarter, the total employee count stood at 3.46 lakh against 3.45 lakh on a sequential basis.

HCL profit up 19%

HCL Technologies saw its consolidated net profit rise nearly 19 per cent to Rs 4,096 crore from Rs 3,448 crore in the same period of the previous year.

This was above analyst estimates of around Rs 3,700 crore.

Revenues also beat Street expectations as they rose to Rs 26,700 crore from Rs 22,331 crore in the same period of the previous year.

However, the country’s third largest software company reduced its revenue guidance for the full year to 13.5-14 per cent from 13.5-14.5 per cent earlier.