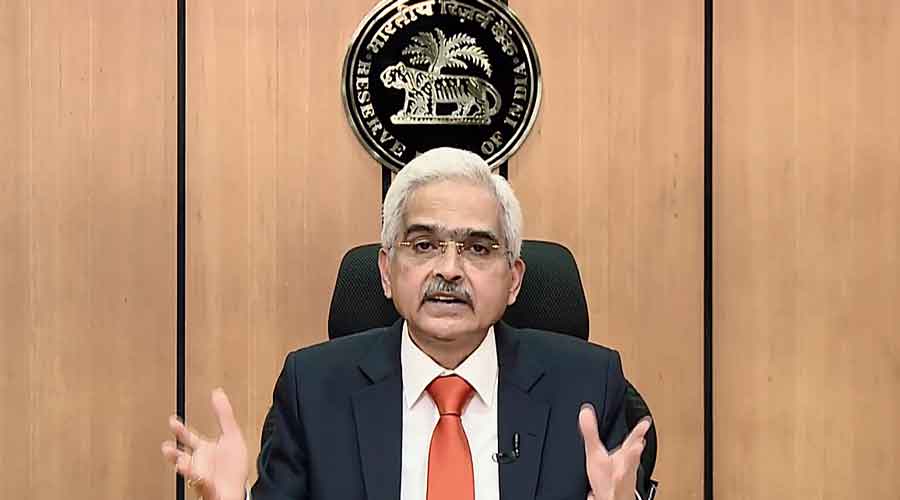

Reserve Bank of India governor Shaktikanta Das on Friday said the latest dataprints on growth, inflation and currency volatilities indicate the worst is over for the financial markets and the world economy. But high interest rates for a longer period look a distinct possibility, he said.

Though the global economy is projected to contract significantly in 2023, the worst, both in terms of growth and inflation, seem to be over.

Lately, with some ebbing of Covid-related restrictions and cooling of inflation in various countries, though still elevated, central banks have started what appears to be a pivot towards lower rate hikes or pauses, Das told the annual meeting of the Fixed Income Money Market and Derivatives Association of India (Fimmda) and the Primary Dealers Association of India (PDAI) held in Dubai on Friday.

But Das put a caveat saying central bankers continue to emphatically reiterate their resolve to bring inflation down closer to their respective targets. At the same time, high policy rates for a longer duration appear to be a distinct possibility.

On the growth front, projections are now veering around to a softer recession as against a severe and more widespread recession projected a few months back.

On the domestic economy, he said, in this hostile and uncertain international environment, “our economy remains resilient”, drawing strength from its macroeconomic fundamentals.

“Our financial system remains robust and stable. Banks and corporates are healthier than before the crisis. Bank credit is growing in double-digits. We are widely seen as a bright spot in an otherwise gloomy world. Our inflation remains elevated, but there has been a welcome softening on November and December. Core inflation, however, remains sticky and elevated,” the governor said.

On the domestic financial markets, Das said since the1990s, “we have come a long way in developing the financial markets”.

Further, the external debt ratios are low by international standards. This has enabled the Reserve Bank to eschew measures to control capital flows and take steps to further internationalise the rupee, even during episodes of significant capital outflows.