The RBI’s growth and inflation forecasts indicate a Goldilocks Effect on the economy by the second quarter of the next fiscal — but analysts remain sceptical on whether such an outcome will play out over the next six to seven months.

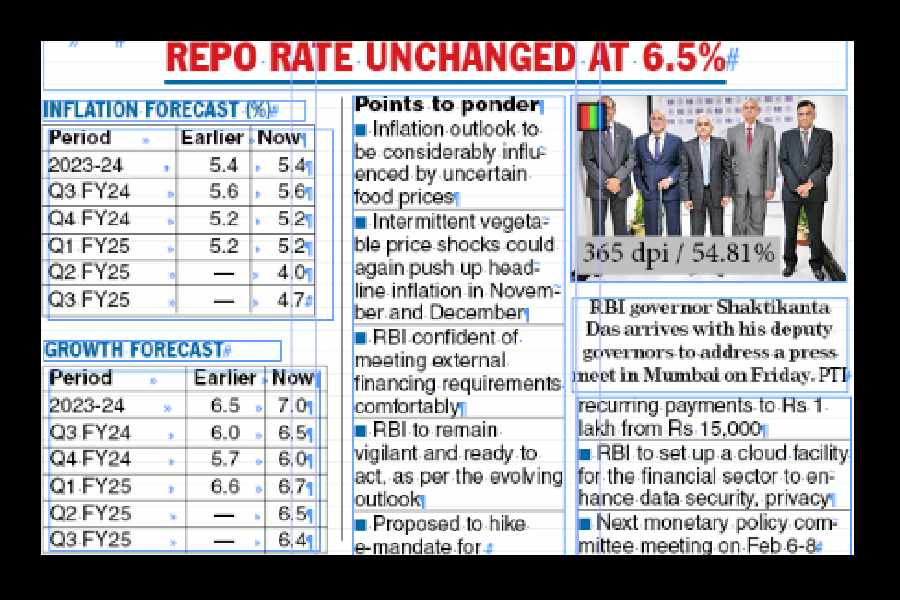

The RBI, which wound up its bi-monthly meeting of the monetary policy committee (MPC)on Friday, has projected growth to hit 7 per cent this fiscal, while inflation will slide down to 4 per cent by the end of the second quarter next fiscal.

The twin prophecies have raised the prospect of the so-called Goldilocks Effect of growth without an inflation spike even as economists remain doubtful given the uncertainties surrounding inflation.

The biggest surprise of the three-day MPC meeting was the upward revision of GDP growth for this fiscal to 7 per cent with RBI deputy-governor Michael Patra saying the figure was a “conservative estimate”.

“If you look at October and November high-frequency data, which we use for our forecasts now they are all very robust. If you just take these two months you will exceed 7 per cent. So the projected 7 per cent is like a conservative estimate,” Patra said.

The Telegraph

Vivek Kumar, economist, Quantico Research, said India is probably one of the major economies that is experiencing a Goldilocks scenario, marked by economic conditions being neither too hot nor too cold.

“An uptick in growth sans any inflation spike is possible as well as sustainable if the same is led by investments rather than consumption, as is the case currently. This will hopefully remain supplemented by a cautious stance towards monetary policy, which takes a balanced approach between overtightening and a premature accommodation,’’ he added.

Economists at CareEdge pointed to the risks of high inflation. ``The positive economic data has brightened growth prospects, leading to an upward revision of growth projections by the RBI. However, the central bank remains mindful of the downside risks stemming from expected muted agricultural output and potential spillovers from global uncertainties,’’ they added.

Aditi Nayar, chief economist, at Icra, warned that while growth will moderate over the next two quarters, inflation is likely to chart a volatile trend.

“RBI’s bet on resilient and high growth while keeping inflation contained is probably correct. Risks to headline CPI inflation now are largely from food prices, which depend on the vagaries of weather shocks, and to an extent on global agri commodities prices. These have to be addressed more by fiscal, farm and trade policies, like fertiliser subsidies, calibrated MSP hikes, export restrictions, imports, etc,” Saugata Bhattacharya, an independent economist said.

RBI governor Shaktikanta Das also pointed to the vagaries of inflation that may throw water on the Goldilocks situation.

``Going ahead, the inflation outlook would be considerably influenced by uncertain food prices. High-frequency food price indicators point to an increase in prices of key vegetables which may push CPI inflation higher in the near term. The ongoing rabi sowing progress for key crops like wheat, spices and pulses needs to be closely monitored. Elevated global sugar prices is also a matter of concern,’’ Das said.

He said November CPI inflation could be on the higher side. The last time inflation was below 4 per cent was in September 2019, when it came in at 3.99 per cent. With inputs from Delhi Bureau