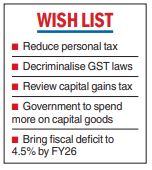

Industry body CII has pitched for a reduction in personal income tax rates, decriminalisation of the goods and services tax and a relook at the capital gains tax rates as part of its agenda presented to the government for the forthcoming Budget.

Arguing that the GST law already contains adequate penal provisions for deterrence against the evasion of taxes, the CII has suggested decriminalisation of GST law.

Also, the applicability of prosecution provisions should not be based on the absolute amount of tax evasion but should be based on real intent to evade the taxes and a certain percentage of the tax payable, it stated.

“A fresh look is needed at the capital gains tax with respect to its rates and holding period to remove complexities and inconsistencies. Moreover, the government should contemplate a reduction in the rates of personal income tax in its next push for reform as this would increase disposable incomes and revive the demand cycle,” CII president Sanjiv Bajaj said.

Tax certainty for businesses should continue and corporate tax rates should be maintained at the current levels, the chamber said, adding that no arrests or detention should take place in civil cases unless criminalisation in business has been proved beyond doubt.

On fiscal consolidation, a key component critical for the revival of growth, the CII suggested that a credible road map be drawn up and announced during the budget, which would gradually bring down the fiscal deficit to 6 per cent of GDP in FY24 and 4.5 per cent by FY26.

In investment, the prebudget memorandum presented to the finance ministry recommended raising capital spending to 3.3-3.4 per cent of GDP in FY24 from 2.9 per cent, with an aim to increase it to 3.8-3.9 per cent by FY25.

It also suggested increasing outlays on green infrastructures such as renewables along with traditional infrastructures, such as roads, railways, and ports. In addition, full implementation of Gati Shakti and NIP (National Infrastructure Pipeline) should be expedited to bring efficiency to infrastructure creation.

For financing infrastructure, the industry body has recommended deepening corporate bond markets (including infrastructure bonds), prioritising a package for large play of urban municipal bonds and launching a Blended Finance Star Multiplier programme for sustainability projects with an allocation of Rs 10,000 crore, among others.

“Private sector investment also needs a boost as a public investment alone is not enough to energise growth in the economy. Private Sector Participation in PPPs should also be revived through timely payments, Swift Dispute Resolution Mechanism,s and expediting the land acquisition process,” CII stated.