During the quarter, it made a provisioning of Rs 1,253 crore towards IL&FS Group. For the full year, provisions stood at Rs 1,803 crore.

It has a 70 per cent provisioning for exposure to the holding company and a 25 per cent to the SPVs.

Sobti said the bank has made a sufficient amount of provisioning for the exposure to the IL&FS Group.

“We have good reason to believe and there are indications in the market that there could be 90-100 per cent recovery on this particular exposure,” he said.

The net interest margin stood at 3.59 per cent against 3.97 per cent a year ago.

The announcement of results was delayed as the bank was waiting for a final approval from the National Company Law Tribunal (NCLT) for its merger with microfinance company Bharat Financial, Sobti said.

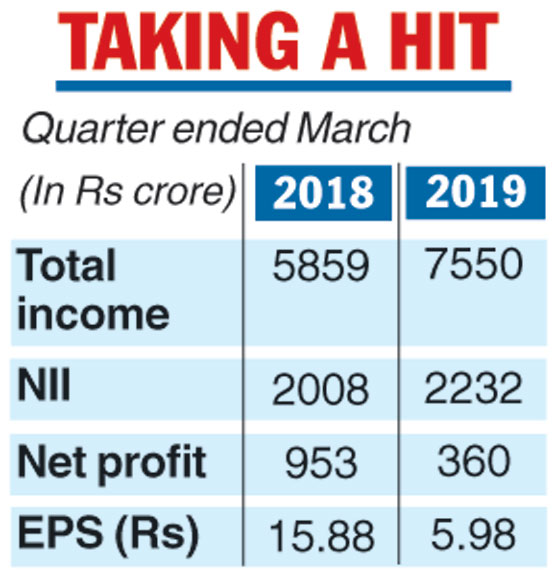

IndusInd Bank on Wednesday reported a 62 per cent fall in net profit at Rs 360 crore for the March quarter of 2018-19 because of higher provisioning for loans extended to IL&FS.

Its profit in the year-ago period stood at Rs 953 crore.

The private lender has a total exposure of Rs 3,004 crore to IL&FS Group, of which Rs 2,000 crore is to the holding company and Rs 1,004 crore to operating companies/ special purpose vehicles.

The entire exposure to IL&FS was classified as an NPA in the fourth quarter.

“While the bank witnessed robust growth in its topline as well as in operating profits, aggressive one-time provisioning for IL&FS depressed the bottomline,” the bank’s MD and CEO Romesh Sobti told reporters.

The Telegraph