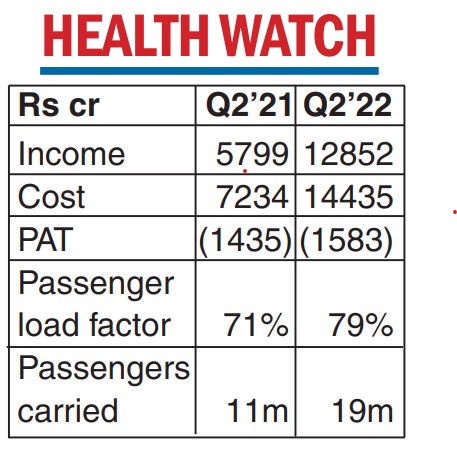

InterGlobe Aviation, the parent of the country’s largest airline IndiGo, saw its losses widening to Rs 1,583.34 crore for the quarter ended September 30, 2022 because of the rupee depreciation and higher fuel costs. The company had posted a loss of Rs 1,435.66 crore in the same period of the previous year.

Total income of the company rose to Rs 12,852.29 crore during the quarter from Rs 5,798.73 crore in the year-ago period. Total expenses spiked to Rs 14,435.57 crore, an increase of over 99 per cent over the corresponding quarter in the previous year. Fuel costs surged to Rs 6,257.9 crore from Rs 1,989.4 crore in the same quarter of 2020-21.

IndiGo CEO Pieter Elbers said that the quarter was the second consecutive period wherein it operated at higher than pre-Covid capacity.

“In spite of a seasonally weak quarter, we witnessed relatively good yields with strong demand across the network. However, fuel prices and exchange rates have adversely impacted our financial performance,” Elbers said.

“We are on a steady path to recovery, benefiting from enormous opportunity both in domestic and international markets. With an industry challenged by global supply chain disruptions, we are working on various counter measures to accommodate this strong demand,” he added.

In the September quarter, the airline said its capacity increased 75 per cent and the passenger numbers rose 75.9 per cent to 1.97 crore.

Yield or the rupee earned for each passenger mile rose 21 per cent to Rs 5.07 while the load factor rose to 79.2 per cent.

IndiGo added that for the quarter, its passenger ticket revenues were Rs 11,110.4 crore, an increase of 135.6 per cent and ancillary revenues were Rs 1,287.2 crore, a rise of 57.4 per cent compared with the same period last year.

Elbers also said the airline has an unparalleled network presence enabling air travel to 74 domestic and 26 international destinations and would continue to accelerate and build on it.

As on September 30, the airline had a total cash balance of Rs 19,660.6 crore, comprising Rs 8,244.2 crore of free cash and Rs 11,416.4 crore of restricted cash. The airline’s fleet stood at 279 aircraft, including 26 A320 CEOs, 149 A320 NEOs, 68 A321 NEOs, 35 ATRs and one A321 freighter at the end of September.

Shares of the airline on Friday ended sideways at Rs 1,797.60 on the BSE.