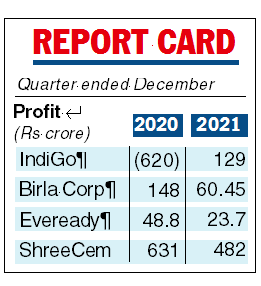

Fuelled by higher passenger revenues, IndiGo on Friday posted a profit after tax of Rs 129.8 crore in the three months ended December 2021 amid the pandemic clouds.

InterGlobe Aviation, the parent of IndiGo, had slipped into a loss of Rs 620.1 crore in the year-ago period.

In a significant development, the company has appointed its co-founder Rahul Bhatia as managing director with immediate effect and he would oversee all aspects of the airline.

Reflecting signs of slow recovery in the pandemic-hit airline industry, IndiGo’s revenue from operations jumped to Rs 9,294.8 crore in the latest December quarter compared with Rs 4,910 crore in the same period a year ago.

Total income surged 84.3 per cent on an annual basis to Rs 9,480.1 crore in the third quarter of the current fiscal year.

“For the quarter, our passenger ticket revenues were Rs 80,731 million, an increase of 98.4 per cent and ancillary revenues were Rs 11,417 million, an increase of 41.3 per cent compared with the same period last year,” IndiGo said in a statement.

Birla Corp profit falls

MP Birla group firm Birla Corporation on Friday reported a decline of 59.27 per cent in its consolidated net profit at Rs 60.45 crore in the third quarter ended December 2021 because of a contraction in cement demand and rise in input costs. It had posted a net profit of Rs 148.42 crore in the October-December quarter a year ago, Birla Corporation said in a BSE filing.

Revenue from operations was down 1.49 per cent to Rs 1,750.06 crore during the quarter under review against Rs 1,776.62 crore.

“Profitability of Birla Corporation Limited’s Cement Division for the December quarter was seriously impacted by a weak demand and a sharp rise in variable costs. Power and fuel cost per tonne went up by 39 per cent year-on-year and 20 per cent sequentially,” it said. EBITDA per tonne for the cement division was down 36 per cent from the year earlier, from Rs 992 to Rs 638.

Eveready net drops

Battery and flashlights maker Eveready Industries India Ltd on Friday reported a 51.41 per cent decline in consolidated net profit at Rs 23.71 crore for the third quarter ended December 31, 2021.

The company had clocked a net profit of Rs 48.80 crore in the year-ago period, Eveready Industries said in a regulatory filing. Revenue from operations was down 4.22 per cent to Rs 325.88 crore during the quarter under review as against Rs 340.27 crore in the year-ago period.

Shree Cements

Shree Cements on Friday reported a decline of 23.57 per cent in its consolidated net profit at Rs 482.70 crore for the third quarter ended December 31, 2021. It had reported a net profit of Rs 631.58 crore in the October-December quarter a year ago, Shree Cements said in a filing to the BSE.

Revenue from operations was up 2.24 per cent at Rs 3,637.11 crore during the quarter under review against Rs 3,557.21 crore a year ago.