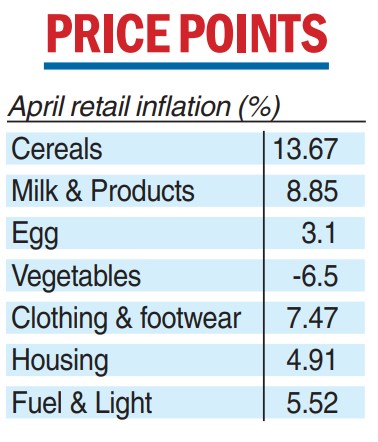

Retail inflation eased to an 18-month low of 4.7 per cent in April, mainly due to the cooling of food and vegetable prices, data released on Friday showed.

This is the second consecutive month that CPI (consumer price index) inflation remained within the RBI’scomfort zone of below 6 per cent.

Retail inflation was 5.66 per cent in March 2023 and 7.79 per cent in the year-ago period.

The April inflation print is the lowest since October 2021 when it was 4.48 per cent.

Core inflation — which is inflation stripped of the food and fuel components and a major concern for policymakers — remained above 5 per cent, though at 5.2 per cent it was lower than estimates of 5.75-5.78 per cent in March.

According to the National Statistical Office, inflation in food and beverages stood at 4.22 per cent in April against 5.11 per cent in the previous month.

The Reserve Bank of India has projected CPI inflation at 5.2 per cent for FY2023-24, with 5.1 per cent in inflation in the first quarter (Q1), 5.4 per cent in Q2, 5.4 per cent in Q3, and 5.2 per cent in Q4.

Aditi Nayar, chief economist, ICRA said: “April 2023 was marked by above-average rainfall and lower than normal temperatures, which helped to keep prices of some vegetables under check.

“Notwithstanding the mixed month-on-month trends across food items, the YoY CPI food inflation is likely to remain subdued in May 2023 aided by the sustained high base (+8 per cent. in May 2022).”

She said with El Nino expected to materialise only in the second half of the monsoon season, kharif sowing may not be impacted.

However, any subsequent deficiency in monsoon rainfall could affect kharif yields and winter sowing, and thereby food inflation, which poses a risk to the CPI inflation trajectory.

Nayar said she expects the monetary policy committee (MPC) of the RBI to continue to press the pause button on rates at its next meeting.

Reserve Bank of India governor Shaktikanta Das on Friday said the cooling off in headline inflation to 4.7 per cent during April is “very satisfying”.

The governor said the release of the official data on Friday gives confidence that the “monetary policy is on the right track”.