Indian stocks fell on Tuesday over fears of high rate hikes by the US Federal Reserve — the Sensex tanked 631 points, while the Nifty declined 187 points — as investors stay cued to US retail inflation data to be released on Thursday.

The rupee, however, gained 57 paise because of a weakening dollar overseas. Comments by two officials of the US Federal Reserve rattled investors: Raphael Bostic and Mary Daly said the Fed will have to raise rates to 5 per cent and even beyond to tame inflation.

At its December meeting, the Fed raised interest rates by a lower margin of 50 basis points — against 75 basis points previously — to a targeted range of between 4.25 per cent and 4.50 per cent.

Among the two Fed officials, Bostic reportedly said the case for a lower increase of 25 basis points at the Fed meeting later this month would depend on the US retail inflation number which will be released on Thursday.

Their comments led to a weak trend in the European markets and the impact was felt by domestic stocks.

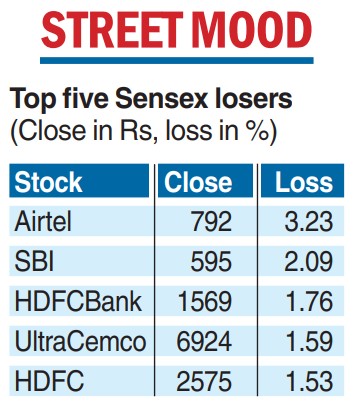

Equity benchmarks Sensex and the Nifty ended with losses of over 1 per cent with the 30-share gauge plummeting 631.83 points, or 1.04 per cent, to settle at 60115.48 after crashing by 808.93 points, or 1.33 per cent, to 59938.38 intra-day. On the NSE, the broader Nifty declined 187.05 points, or 1.03 per cent, to end at 17914.15.

However, it was the rupee’s movement that stole the limelight as it moved past the 81 mark to close at 81.79 against the dollar — a gain of 57 paise over the previous close of 82.36.

Dealers said the main reason behind the rupee’s gain was the trend in the dollar index which gauges the greenback’s strength against a basket of six currencies.

Though it was trading with gains of almost 0.48 per cent at 103.39, the index has declined from over 104 levels prevailing last week. Analysts said dollar inflows from bond sales overseas also aided the rupee.

“The rupee became the best performer among the Asian currencies following stop order triggers and inflows from bond selling,” Dilip Parmar, research analyst, HDFC Securities said.

“The local unit witnessed the biggest single-day gains after November 11 and broke the psychological level of 82 as the traders rushed to cover the positions.’’ Parmar said the domestic currency has the support of 81.70.

In stocks, disappointing profit numbers from Tata Consultancy Services (TCS) also contributed to the lower close. Shares of the country’s largest IT services firm dipped over 1 per cent to close at Rs 3,286.20 on the BSE.

According to Vinod Nair, head of research at Geojit Financial Services, the global bourses reversed their recent gains as Fed officials stated that policymakers would raise the rate beyond 5 per cent and hold on for a while.