Half a dozen tankers carrying Russian crude oil that had been waiting for weeks to deliver their cargoes to Indian ports have changed course and are believed to be headed for China amid problems over payments.

Tracking data shows the vessels sailing toward the Malacca Strait. “Seemingly all six tankers have started to sail towards China,” Viktor Katona, lead crude analyst at data intelligence provider Kpler, says.

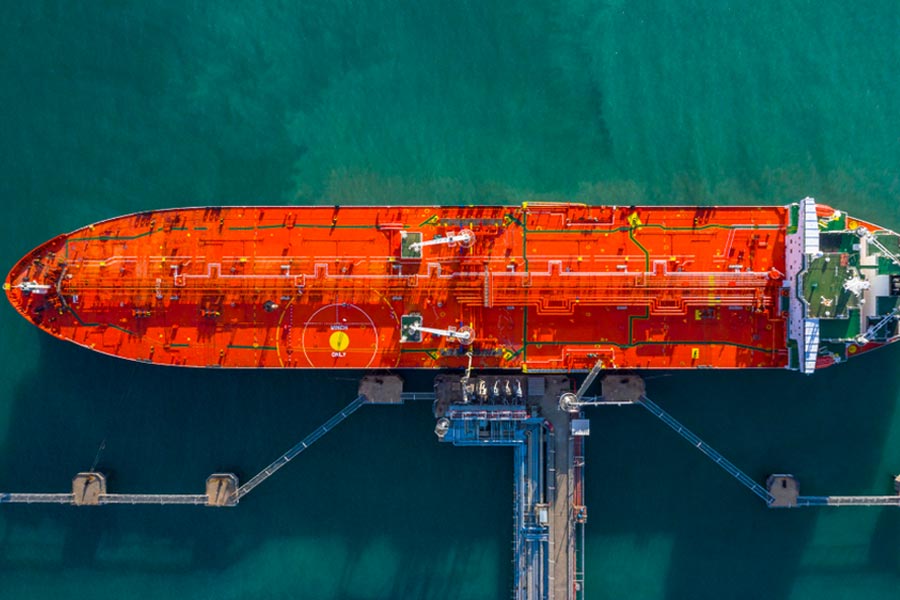

The ships are all carrying Russian Sokol grade crude produced in the country’s Far East Sakhalin-1 field and most of the vessels belong to Russian shipping company Sovcomflot. The ships were due to unload their cargoes in Vadinar and Paradip where IndianOIl has huge facilities.

India’s imports of Russian crude slumped sharply last month to 1.48 million barrels per day (bpd), the lowest since January 2023, and far below the 2.15 bpd peak hit in May of last year as a result of the payments problem. At the peak, 45 per cent of India’s oil imports came from Russia, up from virtually nothing before the invasion of Ukraine in February 2022.

The fall in imports of Russian crude is largely due to the fact that no Sokol grade crude came into India in December. India has been paying for Sokol grade crude in dirhams, the UAE currency, but suppliers are reportedly having difficulty opening accounts and accepting payment.

“The big change in December 2023 was the absolute absence of Sokol imports. December marked the first and only month in 2023 when India didn’t buy Sokol crude,” says Katona. “The amount of the Urals crude that Indian refiners are buying is much the same,” he says.

Russia’s flagship Urals grade, is a far bigger export stream than any other crude that Russia sells. But Indian refiners have always been comfortable buying Sokol because ONGC Videsh owns 20 per cent of the Sakhalin 1 project, notes Katona. “There’s direct hands-on knowledge about the grade and production thereof,” he says

But there may be a possibility that the Sokol payments problem will soon be resolved. Three other ships laden with Sokol grade crude appear to be still heading towards India, according to tracking data, The NS Antarctic and the NS Jaguar are shown as heading to Paradip while the NS Vostochnyy Prospect is bound for Vadinar on the west coast. “Perhaps it’s too early to write off India’s appetite for the Sakhalin grade,” says Katona.

Western sanctions represent another hurdle for Indian crude buyers. One of China-bound vessels, the NS Century, is sanctioned by the G7 for selling oil at over the $60 maximum price to countries around the world. The price cap is intended to reduce Russia’s oil revenues that can be used to fight the Ukraine war. Indian officials, wary of angering the US, had been considering whether to allow the NS Century to dock.

Reliance was initially the biggest buyer of Russian crude oil but now since May it has, in most months, been outstripped by IndianOIl, the country’s largest refiner. A large amount of ESPO diesel-rich grade goes to China so there isn’t much left for India. Says Katona: “The very robust Chinese demand-pull limits the volume that remain available for Indian buyers,” he says.

India could be in a fix about its oil imports and exports unless it can fix its Russian payments problem. About 33 per cent of its imports reach the country via the Suez Canal and the Red Sea where Yemen’s Iran-backed Houthi rebels are attacking shipping with missiles and drones. However, the Houthis are not attacking Russian vessels as Moscow is seen as an Iranian ally. About 25 per cent of India’s oil products exports reach Europe via the Red Sea

There are indications that the Red Sea clashes could escalate because an Iranian naval ship has now crossed into the region, sparking fears it could end up clashing with US ships which are also present. US helicopters Sunday sank three small Houthi boats that were attempting to board a merchant vessel and killed 10 Houthis.

Several large shipping companies like Maersk and Hapag-Lloyd have now stopped sailing via the Suez and the Red Sea. Insurers, meanwhile, are demanding huge premiums from ships travelling through the region.

India fell back on its key traditional supplier and imported more Iraqi oil in December, to make up for the shortfall of Russian crude. Iraqi Basrah Medium grade crude is about $1.50 cheaper than Saudi Arabia’s Arab Medium.