The Indian economy is expected to grow 9.2 per cent in the current fiscal, rekindling optimism about the future after the nightmarish 7.3 per cent contraction in the previous year.

The claw back to growth has been aided as much by a favourable base effect as a rebound in economic activity across all sectors of the economy including agriculture, manufacturing and services.

One sobering thought is that the economy isn’t growing as quickly as the Reserve Bank of India and the International Monetary Fund (IMF) have forecast. Both expected the Indian economy to grow by 9.5 per cent.

The first advance estimate of national income and growth put out by the National Statistical Office (NSO) on Friday showed that in absolute terms, real GDP is estimated at Rs 147.54 lakh crore at 2011-12 prices, which is about 1.26 per cent higher than the Rs 145.7 lakh crore in the pre-Covid fiscal of 2019-20.

This isn’t big but it suggests that at least the clouds of statistical gloom have started to lift even if such a perception isn’t visible on the ground.

The other big statistical achievement – which the Modi government is certain to crow about – is the fact that the NSO has forecast nominal GDP at Rs 232.15 lakh crore, about 4.16 per cent higher than the Rs 222.87 lakh crore that finance minister Nirmala Sitharaman had projected in her budget last year.

A higher nominal GDP will help the Modi government to put a lid on the fiscal deficit which was projected in Budget for Fiscal 2021-22 at 6.8 per cent. If the government is able to hold fiscal deficit at the projected Rs 15.06 lakh crore, then the higher nominal GDP in the NSO release will help pare fiscal deficit to 6.49 per cent.

Sitharaman and her budget team will be certainly chuffed about that as they huddle in their preparations for next year’s budget which will be presented on February 1.

But there are several concern as well in the NSO numbers: the first is that private final consumption expenditure (PFCE) isn’t back to pre-Covid levels. At Rs 80.80 lakh crore, PFCE is 6.87 per cent higher than last year’s Rs 75.61 lakh crore. But it is about 1.26 per cent lower than the Rs 83.22 lakh crore in 2019-20.

It is clear that this economy is running on government spending which is forecast to increase by 7.6 per cent to Rs 17.07 lakh crore from Rs 15.87 lakh crore last year.

The worry is that unless private consumption starts to kick in soon, the economy will wobble unless Sitharaman is prepared to crank up government spending in her looming budget with another burst of borrowings. This may be hard to do – and indeed justify -- when advanced economies start to roll back their economic stimulus programs.

Omicron concerns

Economists have already started to express misgivings about the NSO estimates, arguing that it doesn’t seem to have factored in the anticipated effects of the Omicron-induced third Covid wave which could force a revision in the estimates when the second advance estimates are put out on February 28.

“The advance estimates are projections based on two quarters of economic growth and the numbers should be taken with a pinch of salt. Though the economy is showing signs of recovery, the final numbers are likely to be revised downwards and we are estimating around 9 per cent growth for the current fiscal,” said N.R. Bhanumurthy, Vice-Chancellor, Ambedkar School of Economics University.

Aditi Nayar, chief economist of ICRA said: “The implicit GDP growth of 5.6 per cent for the second half of FY2022 built in by the NSO may not fully factor in the admittedly evolving impact of Omicron. Our sense is that after a 6.0-6.5 per cent rise in Q3 FY2022, the GDP expansion is set to slip below 5.0 per cent in the ongoing quarter.”

The NSO highlighted the fact that nominal gross value added (GVA) – which strips out taxes and subsidies from the value of output – had risen by 17.4 per cent to Rs 210.37 lakh crore from Rs 179.15 lakh crore last year.

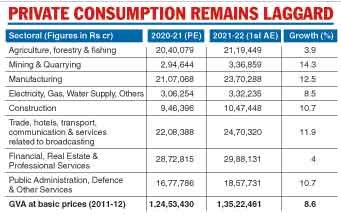

However, real GVA (calculated at 2011-12 prices) rose by a more modest 8.6 per cent to Rs 135.22 lakh crore from Rs 124.53 lakh crore last year.

Madan Sabnavis, chief economist at Bank of Baroda said: “The (advance) estimate does not take into account the Covid impact and hence there can be a downward bias to this number. Growth of 9.2 per cent would be reduced to around 1.3 per cent over FY20 and hence this indicates that we have just about recouped our loss in GDP last year.”

“Most conspicuous amongst the disaggregated data is the weak performance of private final consumption expenditure and trade, hotel, transport, communication etc., which are pegged to trail their FY2020 levels by 2.9 per cent and a considerable 8.5 per cent, respectively, underscoring the lingering impact of Covid-19 on the Indian economy,” Nayar added.

The fine print indicates that “valuables” are estimated to grow by 75.24 per cent to Rs 294,022 crore. Economists said the increase in the "valuables" indicates that people are buying gold, precious stones and art works to hedge against inflation amid Covid-19 uncertainty.

Most key sectors are estimated to see double-digit growth aided by the base effect. Agriculture sector is estimated to grow by 3.9 per cent in FY22 compared with a growth of 3.6 per cent in FY21. The mining sector growth is likely to grow by 14.3 per cent after a contraction of 8.5 per cent in the previous year.

Manufacturing sector growth is estimated at 12.5% after a contraction of 7.2% in the previous year. The numbers are in sharp contrast with the IIP numbers clearly putting a question mark on the reliability of survey based IIP data.

India to outdo Japan

India is likely to overtake Japan as Asia’s second-largest economy by 2030 when its GDP is also projected to surpass that of Germany and the UK to rank as world’s No.3, IHS Markit said in a report on Friday, according to PTI.

At present, India is the sixth-largest economy in the world, behind the US, China, Japan, Germany and the UK.

“India’s nominal GDP measured in USD terms is forecast to rise from $2.7 trillion in 2021 to $8.4 trillion by 2030,” IHS Markit Ltd said.

“This rapid pace of expansion would result in the size of Indian GDP exceeding Japanese GDP by 2030, making India the second-largest economy in the Asia-Pacific region.”

By 2030, the Indian economy would also be larger in size than the largest Western European economies of Germany, France and the UK.

“Overall, India is expected to continue to be one of the world’s fastest-growing economies over the next decade,” it said.