The Telegraph

A reduction in the import of coking coal is a challenge before the country’s steel players in meeting the target production of 300 million tonnes by 2030-31.

According to the steel industry, around 85 per cent of the coking coal requirement of manufacturers is currently coming from imports, while the remaining is from domestic production, including that of Coal India. However, the National Steel Policy has envisaged an increase in the share of domestic washed coking coal and a lowering of import dependence to 50 per cent by 2030-31.

To achieve a target of 300 million tonnes of crude steel production, the estimated coking coal requirement is around 161 million tonnes. But, the bulk of the 34.5 billion tonnes coking coal reserves in the country is not adequate to form good quality coke because of the high impurity in indigenous coal.

“This is an area of concern for the steel industry. The primary nations from where coking coal is imported are Australia, Canada and some bits from South Africa. But the landed cost is very high.

“At the same time we are not able to exploit the domestic reserves. While efforts are on to increase production of coking coal but even when we produce the quality is not good. The R&D initiatives is to try and see how much of non coking and coking coal we can mix and if we can do that there will be lesser deficiency,” Bhaskar Chatterjee secretary- general of the Indian Steel Association told The Telegraph on the sidelines of an mjunction-organised coal sector seminar on Tuesday.

He added that while the blending ratio is as high as 40 per cent in countries such as the US, in India it is less than 10 per cent. “Commercial viability of blending is not yet established but there is hope that in the next 2-3 years, there would be some development,” said Chatterjee.

“The economic ash content in indigenous coking coal being 18 per cent, its use by 30 per cent in the blend is unlikely to produce quality coke. India has to heavily depend on imported coking coal for its plan to produce 300 mtpa crude steel by 2030-31,” said former Coal India chairman N.C. Jha.

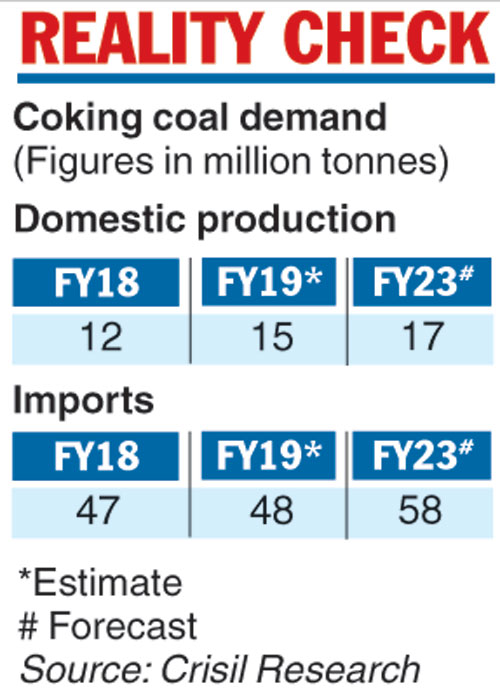

According to Crisil, growth in steel production is expected to push up demand for coking coal to 65mt in 2022-23 from 51mt in 2017-18.

The share of imports is estimated to remain at 85-87 per cent over the next five years. In absolute terms, coking coal imports are expected to increase to 58mt in 2022-23 from 47mt in 2017-18.