India has the potential to become a $55 trillion economy by 2047 with an 8 per cent annual growth rate.

But the country will be able to achieve this challenging goal only if it is able to trigger three key growth drivers, says Krishnamurthy Subramanian, executive director at the International Monetary Fund and the former chief economic adviser to the government of India.

The formalisation of the economy, increasing the share of private credit creation and greater role of private sector in promoting innovation and entrepreneurship leading to higher productivity are the growth drivers.

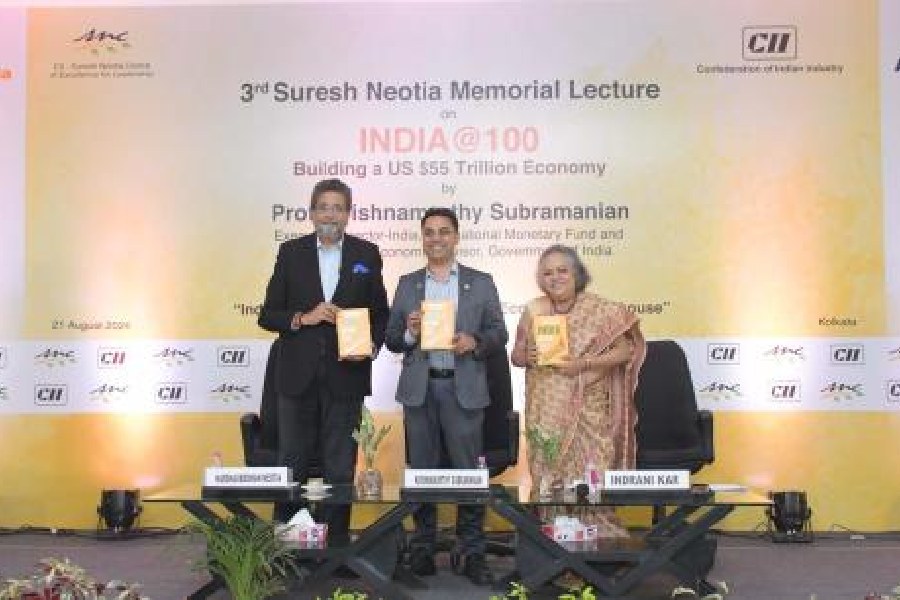

“The bottomline prediction I have is when India celebrates its centennial year in 2047, India can be a $55 trillion economy if we grow at 8 per cent in real terms,” Subramanian said addressing the Suresh Neotia Memorial Lecture organised by CII Suresh Neotia Centre of Excellence for Leadership on Wednesday.

A book titled “India@100: Building a US $55 Trillion Economy” authored by Subramanian was also launched.

The growth forecast depends on two assumptions: first, the rate of inflation will be 5 per cent, close to the upper range of RBI’s mandate to limit it between 2 and 6 per cent. Second, the annual rate of depreciation in the exchange value of the rupee against the US dollar will be less than 1 per cent against current levels of 3-3.5 per cent.

Subramanian said before 2016, India’s average inflation was about 7.5 per cent and from 2016 till March 2024, the average rate of inflation was 5 per cent. Higher inflation translates into higher depreciation of the currency and lower inflation means lower depreciation, he added.

“There are three key drivers in my opinion that can deliver 8 per cent growth. A large part of our economy is still informal. Firms in the informal sector are far less productive than firms in the formal sector. Formalisation increases productivity. Today there is a huge runway for formalisation and thereby productivity improvement.”

“Even in the formal sector, firms are still not as productive as their global peers. This provides another opportunity for productivity improvement. Combination of innovation and entrepreneurship will lead to improvement in productivity,” he said.

“The third driver is credit creation. If we look at private credit to GDP ratio, in 2020 it was at 58 per cent in India. The global average in 1960 was 60 per cent. In terms of high-quality credit creation, we are still six decades behind. There is a higher runway that we have for credit creation,” he said adding that there is need for greater credit flow to the small and medium enterprises.