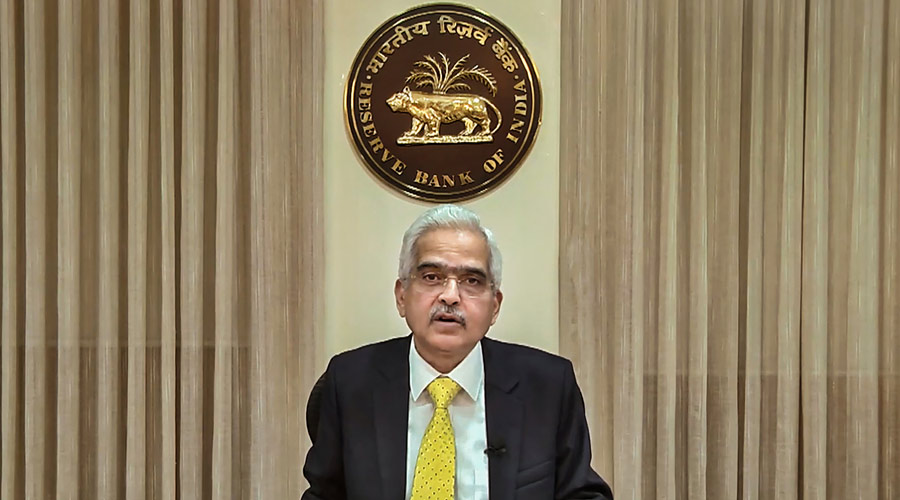

Reserve Bank Governor Shaktikanta Das on Saturday underlined the need for using the G20 presidency to present India's e-payment story to the global audience and seize the opportunity to internationalise payment products like UPI and RuPay.

India's home-grown payment products like UPI and RuPay network are increasing their global footprint and will make cross-border payments easier, Das said while inaugurating the Payment System Operators (PSO) Conference here.

"Under Reserve Bank's Payments Vision 2025, we stand committed to the core theme of 'E-Payments for Everyone, Everywhere, Everytime' (4Es). We must seize every opportunity to internationalise our payment products. This will open up a new world of opportunities for our country. This is the year of the Indian Presidency of the G20. Let us present the India story to the global audience," he said.

The governor further said with the Indian economy getting increasingly integrated with the global system, crossborder payments have assumed greater significance.

"Our home-grown payment products, UPI and RuPay network, are enhancing their global footprint," he said and added launch of UPI linkage with Singapore's PayNow is a major step forward.

In future, Das added such linkages with other countries will make crossborder payments simple, affordable and real-time.

QR code-based merchant payments through UPI apps are already enabled in Bhutan, Singapore and the UAE. All these would also help project India's soft power at the global level.

"I would like to say that a lot has been achieved but a lot more can and should be done in the days ahead," he said.

Das emphasised that payments and settlements are serious businesses with potential downsides, should anything go wrong. Effort should be to mitigate such downsides and capitalise on the upsides.

"This is something all market participants must recognise and constantly remind themselves. Every failed transaction, every fraud attempted or actually carried out, every complaint that is not satisfactorily addressed should be a cause of concern and must invite a detailed root cause analysis.

"It would do well to remember that like the batsman on the cricket field, you are only as good as the last ball faced. We must together make sure that no one in the country is left behind in the digital payments journey," he said.

The launch of Unified Payments Interface (UPI) in 2016 has revolutionised the payments ecosystem with about 803 crore transactions worth Rs 13 lakh crore processed in January 2023 alone.

Das further said widespread use of mobile phones, coupled with availability of internet services, have provided thrust to digital payments.

This has led to “anytime anywhere” banking which transcends traditional branch banking hours. About 1,050 crore retail digital payment transactions worth Rs 51 lakh crore processed in January 2023 stand as testimony to the size and efficiency of India's digital payments, he said.

Except for the headline, this story has not been edited by The Telegraph Online staff and has been published from a syndicated feed.