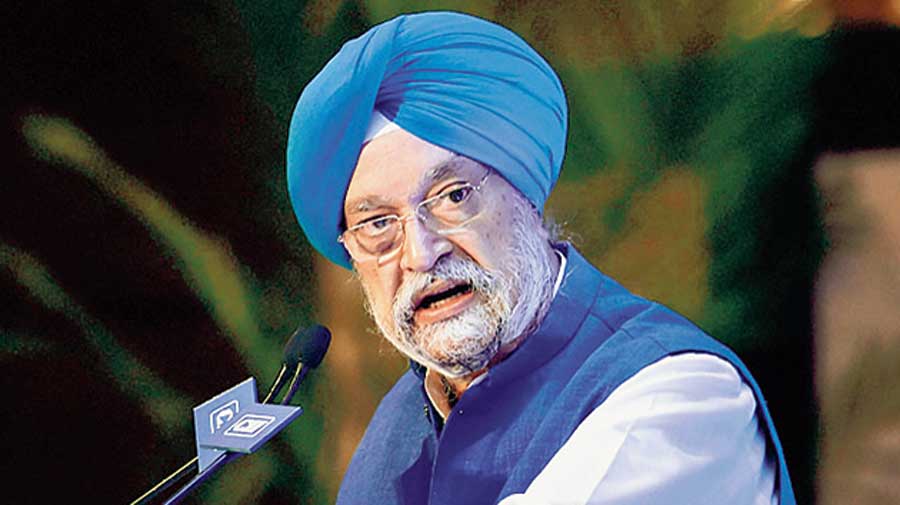

Oil minister Hardeep Puri told the Lok Sabha on Thursday that India is looking to increase its dependence on the domestic production of oil and gas.

The government plans to bring 30 per cent of the sedimentary area under oil exploration. The country has 26 sedimentary basins covering around 3.3 million square kilometres.

“Today, the sedimentary area under exploration production has gone up from 6-7 per cent to 10 per cent. It is our expectation that this will go up to 15 per cent very shortly, and go on to 30 per cent after that,” Puri said.

He said “it should be our endeavour, especially since we import 85 per cent of our requirements of crude, and about 50 to 55 per cent of gas, that we should become totally self-reliant on our own”.

Puri’s statement flies in the face of the situation in the ground where India’s ageing reserves aren’t being tapped because of the huge risks involved.

He said the government is trying to sweeten the terms of engagement with foreign investors in India’s oil sector by dropping the production sharing terms that have underpinned oil hunt contracts till now.

He gave the details of what he termed as “India’s new oil policy” in reply to a question raised in the Lok Sabha.

The policy is actually old – it was framed in 2019 and has not met with great outcomes as foreign investors are not keen to commit to India.

Under this policy, “Revenue is to be shared with Government in case of windfall gain i.e. when revenue exceeds $2.5 billion in a financial year,” Puri said in his reply to the House, articulating for the first time the cornerstone of this policy.

Analysts said India has poor data on geological prospects compared with some other countries and has been unable to attract global players, mainly because of their averseness to investing millions in surveying and drilling wells to establish reserves.

Investors prefer to enter into established fields where return on investment is assured.

Foreign participants also accord priority to commercial aspects and the prevailing business climate.

The minister said the oil import bill had increased to $9.9 billion during April to January of FY22 compared with $7.9 billion during FY21 because of higher demand, price increase in international markets and exchange rate changes.

Global rating agency Moody’s Investors Service said the three state owned oil marketing companies have lost around $2.25 billion in revenue between November and March by keeping petrol and diesel prices unchanged despite a sharp rise in crude oil prices.

“The ongoing pressure on the Indian crude basket due to the global developments will have adverse growth and inflation effects,” D.K. Srivastava, chief policy advisor, EY India, said.