India in a surprise move hit the pause button in raising interest rates amid global turbulence caused by the biggest banking scare since the 2008 financial crisis and concerns that the domestic economy may be losing steam.

The Reserve Bank of India (RBI) left its trendsetting repurchase rate or repo rate on hold at 6.50 per cent. It’s following the lead of other central banks which have kept their monetary policy unchanged on the back of recent US banking collapses and the takeover of Credit Suisse by its peer UBS.

The Indian central bank said the decision didn’t mean the country’s rate-hiking cycle is over.

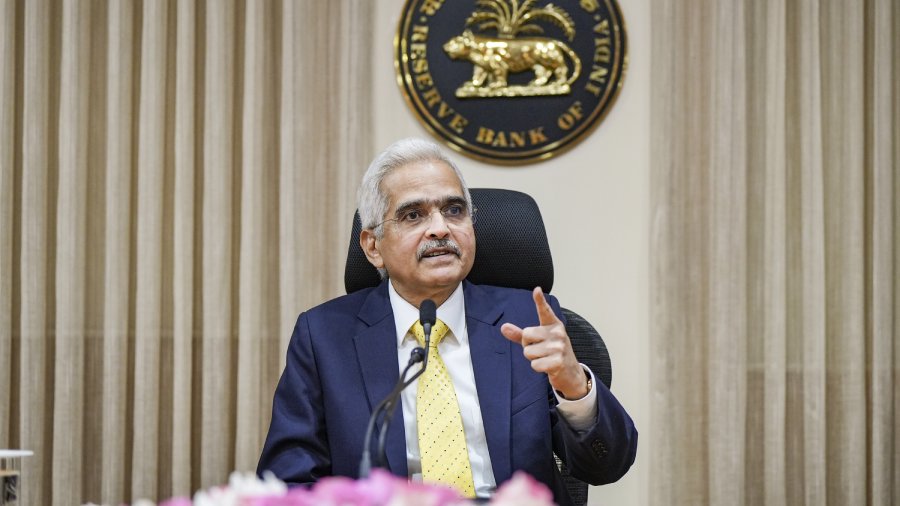

Reserve Bank chief Shaktikanta Das said the bank left rates unchanged because it needed to assess the impact of the total 250-basis points in rate increases it has implemented since May 2022.

Das stressed that the pause in rate rises was “for this meeting only” and that the decision was a “pause, not a pivot” as he emphasised that “the war against inflation has to continue”.

Das said “overall, we are optimistic about the economy” but he added that the “outlook is now tempered by additional downside risks from financial stability concerns”, although he said that Indian banks “remain healthy.”

Bank lending growth has eased in one early sign that the domestic economy is losing steam and the central bank noted that “private consumption is showing some signs of slowdown.”

“We have to be extremely prudent in our actions,” Das said.

The central bank slightly hiked its growth prediction for the 2023-24 financial year to 6.5 per cent from 6.4 per cent but that is a slowdown from its forecast for the last financial year of 7 per cent growth. Many economists said the bank is being too bullish in its forecasts.

“The decision to pause… is probably a reflection of the extreme uncertainty which characterises the global economy, and the risks of its potential spillovers into India,” said Axis Bank chief economist Saugata Bhattacharya.

Most economists had expected the RBI to raise rates this time round. While year-on-year Inflation eased in February to 6.44 per cent from 6.5 per cent in January, it’s held stubbornly above the bank’s 6.0 per cent upper limit for 10 out of the last 12 months.

India’s latest round of monetary tightening has been the most aggressive in a decade.

Das said the bank, which has so far raised rates six time in this rate-hiking cycle, remained committed to bringing inflation down to within its 2-6 per cent target. “With unyielding core inflation, we remain firm and resolute in our pursuit of price stability which is the best guarantee for sustainable growth," said the monetary policy committee in its statement.

Most analysts had said they were expecting another quarter-point increase in this rate-hiking cycle.. But some now said they believed India had seen the last increase in this round of rate rises and that the bank could start laying the groundwork for lowering rates by the end of year.

“Given the subdued growth outlook and the likelihood that inflation falls back to within the RBI’s target range before long, our view that the tightening cycle is at an end,” said Shilan Shah, deputy chief emerging markets economist at Capital Economics.

But other economists said that the central bank may just be taking a break.

By “keeping the doors open to further rate hikes, the MPC (Monetary Policy Committee) has clearly signalled that the war against inflation is still not over,” said Rupa Rege Nitsure, group chief economist at L&T Financial Holdings.

“Rather, the RBI wishes to wait and watch how the situation pans out amid the threats of El Nino, the global banking turbulence, OPEC production cuts and geopolitical tensions,” she said.

Upasna Bhardwaj, who’s chief economist at Kotak Mahindra Bank, forecast that the bank would “maintain an extended pause and evaluate the lagged impact of previous rate hikes and global uncertainties on growth-inflation dynamics,"

The Indian currency was trading virtually unchanged after the rate decision at 81.98 rupees to the dollar against 81.88 before the bank’s announcement.