Reserve Bank of India deputy governor Michael Patra has tried to soothe concerns about the anticipated surge in India’s current account deficit, suggesting that the country will not be roiled by a crisis if the CAD climbed to anywhere between 2.5 and 3 per cent of GDP.

“Our experience has been that India can sustain a current account deficit of 2.5-3 per cent without getting into an external sector crisis. In fact, in a telling reminder of this fact, a record increase in oil prices and high gold imports took the current account deficit above this Plimsoll line and to historically high levels during 2011-13,’’ Patra said while delivering a speech to celebrate ‘Azadi Ka Amrit Mohotsav’ organised by the RBI office in Bhubaneswar.

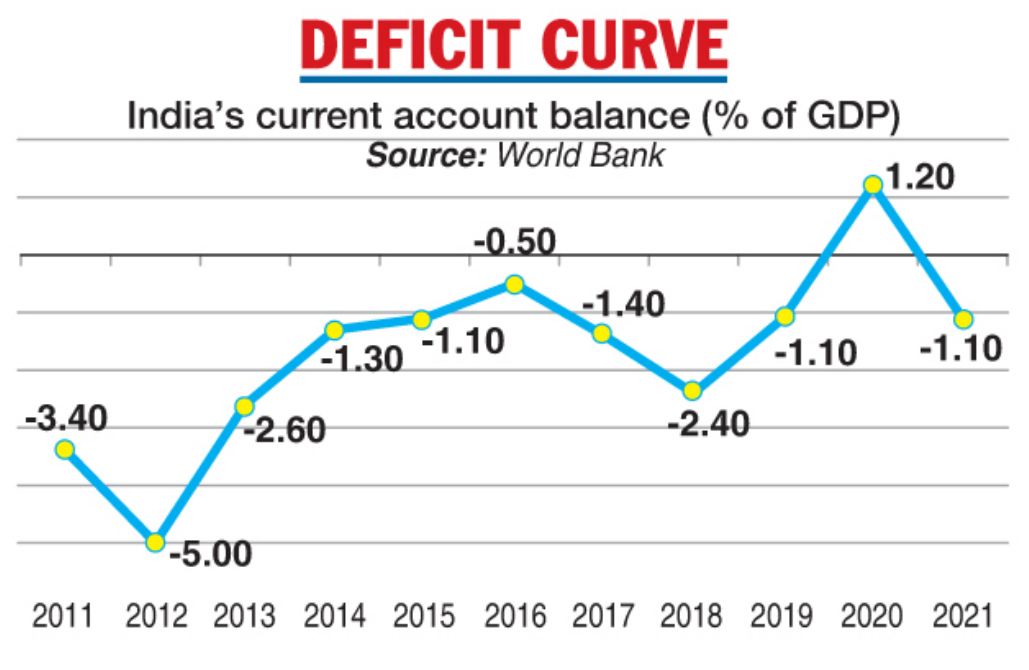

India’s CAD rose to its highest level of 5 per cent of GDP in 2012 when the UPA was in power — and the Modi government has often pounced on this fact to muzzle criticism about the growing trade deficit.

The overall current account deficit in July rose to $21.04 billion (merchandise and services), the commerce ministry reported on Friday.

Data also showed that overall CAD rose to $63.55 billion in April-July this year, an increase of 666.2 per cent over the year-ago period.

Several economists have voiced alarm over the rising CAD with many projecting that it could touch 3 per cent by the end of this fiscal.

CAD is one of the factors that weigh on the exchange value of the rupee, and a widening trade deficit raises fears about importing inflation as the cost of imports increase when the rupee weakens.

CAD, or the inflow and outflow of foreign exchange, had narrowed to 1.5 per cent of India’s GDP, or $13.5 billion, in the quarter ended March 31, 2022 from $22.2 billion (2.6 per cent of the GDP) in the preceding three months, according to RBI data released in June.

For 2021-22, it stood at 1.2 per cent of the GDP against a surplus of 0.9 per cent in the previous year. However, the rising trade deficit has led to some experts predicting that the CAD will rise in this fiscal. Merchandise trade deficit had shot up to $30 billion in July.

Analysts at BoFA Securities said in a report that India’s CAD would reach $105 billion, or 3 per cent of the GDP, due to rising trade deficit.

Second-largest economy

The RBI deputy governor also said that India can ‘bend time’ and become the world’s second-largest economy by 2031 if it is able to achieve a growth of 11 per cent in the next decade by capitalising on opportunities and overcoming weaknesses like loss of output and livelihood.

“If this (a growth rate of 11 per cent) is achieved, India will become the second largest economy in the world not by 2048 as shown earlier, but by 2031. Even if it does not sustain this pace and slows to 4-5 per cent in 2040-50, it will become the largest economy of the world by 2060,” Patra said.