Income tax experts and chartered accountants have started advising their clients to take note of the break-even tax liability while taking a decision on whether to opt for the new income tax regime which has no exemptions.

The changes announced in the Union budget to the new tax regime without exemptions involve tweaking of the tax slabs, introducing standard deduction of Rs 50,000 and raising the tax rebate for income up to Rs 7 lakh, which comes into effect from April onwards.

A break-even threshold calculation essentially involves taking into consideration the amount of deductions under the old income tax regime that is required such that the level of income tax liability is the same in both the tax regimes. This can be explained with an example.

Suppose the gross salary of an individual is Rs 10 lakh. After taking into consideration standard deduction of Rs 50,000 the gross taxable income comes to Rs 9.5 lakh on which the tax liability works out to Rs 54,600 under the new tax regime.

Suppose the individual is able to lower gross taxable income to Rs 7 lakh by claiming various exemptions under section 80C, 80D (Mediclaim) and 24(b) (interest on home loan) etc available under the old tax regime. Then his total tax liability is Rs 54,600, which is same as that under the new tax regime.

In the above example, if the exemption is less than Rs 3 lakh, then tax liability under the old regime is more than the new regime. Conversely if the exemption is more than Rs 3 lakh, then the tax liability in old regime is less than the new regime.

“The moment the amount of available deductions become lesser than the break even point, the tax liability in the old regime is greater than in the new regime and therefore the person should opt for the new regime. If the amount of available deduction is more than the break even point, the tax liability in the old regime is less than new regime and therefore the person should continue with the old regime,” said Mayank Mohanka, partner SM Mohanka and Associates and founder director, TaxAaram India, at a Taxmann organised session.

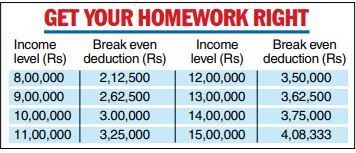

The break even threshold assumes importance for individuals with annual income above Rs 7 lakh where there is no tax rebate under section 87A and it varies across income levels (See Chart).