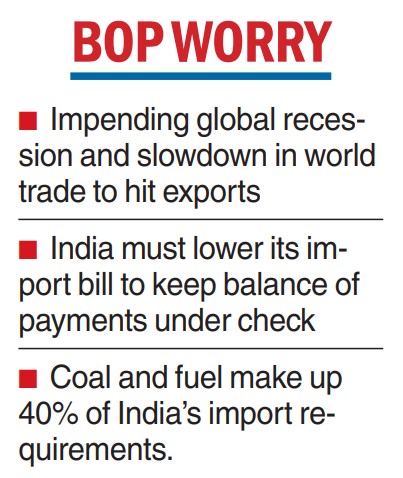

The looming recession in the global economy will drag down exports in spite of the free trade agreements signed or in the making, analysts said.

Faced with an awning balance of payments (BoP) gap, the country should aim to reduce its energy import, they added.

“Indian economy and exports will be moderately impacted by weak global demand and recession in large economies. Planners should aim to cut the energy import bill to improve BoP,” Ajay Srivastava, the co-founder of economic think tank GTRI, said.

As much as 40 per cent of India’s goods import bill of $270 billion in 2022 comprise crude oil and coal.

India must enhance both the exploration of local oil fields and production of coal mines to substantially reduce its energy imports and improve the current account.

Brent crude sells at $83-86 per barrel at present, which will increase if China recovers from the fresh Covid attack and buys more oil and gas from Russia.

High oil and gas prices will affect most countries including India. The country’s growth is best sustained when oil price is around $75 per barrel, Srivastava said.

“The forecast for 2023 is not encouraging particularly as a sizeable number of countries are either in the recession or on the brink of it. The oil and energy prices will determine the course of global trade,” Ajay Sahai, director-general and CEO of the Federation of Indian Exports Organisation.

Sahai said the liquidity challenges and cost of credit are the two key concerns.