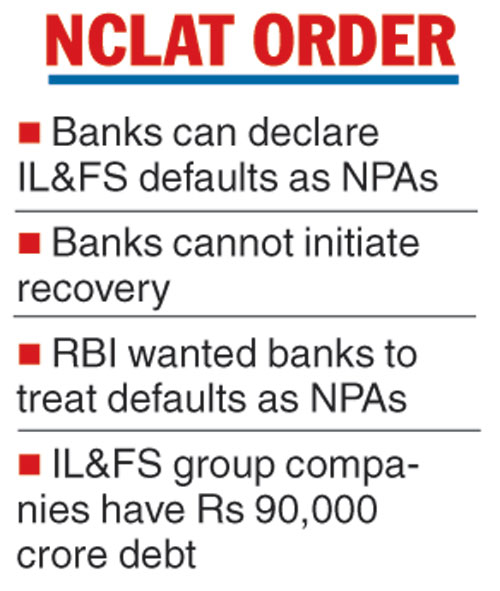

The National Company Law Appellate Tribunal (NCLAT) on Thursday said banks can declare as non-performing assets (NPAs) the accounts of IL&FS and its group companies that have defaulted on their payments.

An NCLAT bench headed by chairman Justice S.J. Mukhopadhaya lifted the embargo on the lenders to declare the accounts of the debt-ridden IL&FS and its 300 group firms as NPAs.

However, the bench clarified the lenders cannot initiate the recovery process from the toxic accounts.

Lenders must not withdraw support until a resolution is found for the IL&FS and its group companies.

At present, Infrastructure Leasing & Financial Services (IL&FS) Group companies, with a collective debt of over Rs 90,000 crore, are going through a resolution process.

The NCLAT had in February prohibited banks from recognising any IL&FS group accounts as non-performing assets without first seeking approval from the tribunal.

The Reserve Bank of India (RBI) then moved the appellate tribunal to modify the order.

The RBI had contended that banks had an obligation to mark bad loans as NPA in cases of non-payment after the default of 90 days as per the existing circular and they could not be relieved of this duty.

The Telegraph

Stating there was an overlap of power, the RBI said as a regulator of banks, it should also be heard on the matter.

The NCLAT bench agreed to hear the RBI even as it asked the apex bank to clarify if its NPA norms and powers came in the way of the successful resolution of the IL&FS companies. The appellate tribunal had asked the Reserve Bank to not to make it a “prestige issue”.

Presently, all group companies of IL&FS are classified according to their ability to meet payment obligations. Entities meeting all payment obligations are categorised as “green”; companies meeting only operational payments and senior secured debt obligations categorised as “amber”. Other IL&FS group companies were categorised as “red”.

The NCLAT order has therefore brought the focus back on the lenders who have an exposure to the infrastructure conglomerate.

Many of them have already classified a part of their IL&FS group exposure (that have defaulted) as an NPA.

A certain portion was classified as standard following the February order of the NCLAT.

The tribunal had then in its order asked banks not to declare their loans to IL&FS and its group firms as non-performing assets without its prior permission.

Last month, the RBI had asked banks to declare the details of their IL&FS group exposure and the portion of the loans that were non-performing, but not classified as an NPA in their notes to financial statements while declaring the quarterly results.

The RBI also told the banks to disclose the provisions that were required to be made and the provisions actually done towards the exposure.