IDBI Bank will continue to operate as an “Indian private sector bank” after its strategic sale and the government’s residual 15 per cent stake in the lender post privatisation will be considered as “public shareholding”, the finance ministry said on Sunday.

An “appropriate dispensation” for the new owner to achieve minimum public shareholding (MPS) over an extended period is under consideration and the winning bidder will have no restriction on undertaking corporate restructuring of the subsidiaries of IDBI Bank, it added.

These clarifications are part of the responses by the Department of Investment and Public Asset Management (Dipam), under the finance ministry, to potential investors’ pre-EoI queries.

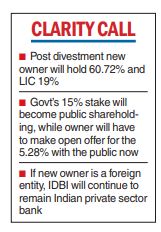

The government had on October 7 invited bids for privatising IDBI Bank and said that it together with LIC will sell a total of 60.72 per cent stake in the financial institution. The last date for putting in expression of Interest (EoI) or preliminary bids is December 16.

The government and LIC together hold 94.72 per cent stake in IDBI Bank. The successful bidder would be required to make an open offer for the acquisition of 5.28 per cent public shareholding.

Pursuant to the transaction, the government will own a 15 per cent stake and LIC 19 per cent shareholding in IDBI Bank, taking their total holding to 34 per cent.

On whether IDBI Bank will be reclassified as a wholly-owned subsidiary in the event that the successful bidder is a foreign bank, Dipam said, “The Target (IDBI Bank) shall post consummation of the transaction continue to function and operate as an Indian private sector bank.”

The government will not have any board seats or participate in the management. “The bidders are informed that GoI has already made application for reclassification of its shareholding as ‘public’. Further, the details regarding such aspects will be provided in the definitive documents (including the share purchase agreement) shared with the QIPs (qualified interested parties) at the RFP stage”.

To another query, Dipam said the aspects in respect of treatment of GoI’s residual shareholding and the appropriate transition period for MPS compliance are under due consideration and would accordingly be communicated to the QIPs at the request for proposal (RFP) stage.

“As regards the MPS requirements, the appropriate dispensation is under consideration. Further clarification would be provided at the RFP stage,” the Dipam said.