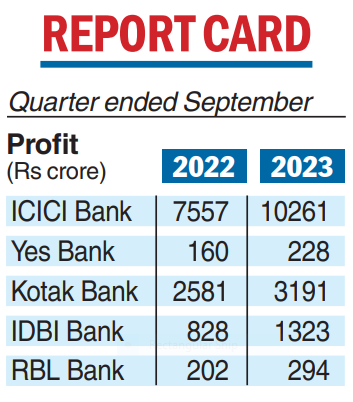

A clutch of private sector banks on Saturday declared their report card for the quarter ended September 30 with most of them, barring Yes Bank, either surpassing or meeting Street estimates. The outperformance was led by ICICI Bank, which recorded a 36 per cent rise in net profits on higher core income.

ICICI Bank posted a net profit of Rs 10,261 crore compared with Rs 7,557.84 crore in the same period of the previous year. Analysts had estimated a number of around Rs 9,400 crore.

The profit came on the back of its net interest income (NII-interest earned minus interest paid) rising 23.8 per cent over the previous year to Rs 18,308 crore from Rs 14,787 crore.

The rise in its bottomline was also helped by lower provisions, which came down to Rs 583 crore from Rs 1,644 crore.

During the quarter, ICICI Bank’s asset quality improved with the percentage of gross non-performing assets (NPAs) to gross customer assets coming down to 2.48 per cent from 2.76 per cent on a sequential basis.

Yes Bank net rises 47%

Rival Yes Bank posted a strong 47 per cent rise in its net profit at Rs 228.64 crore on a lower base. However, it fell short of analysts estimates, which had pencilled in a number of over Rs 300 crore. The bank had recorded a net profit of Rs 160.41 crore in the same period of the previous year.

Kotak Bank net up 24%

Kotak Mahindra Bank reported a 24 per cent rise in its standalone net profit at Rs 3,191 crore compared with Rs 2,581 crore in the same quarter of the previous fiscal year.

Net interest income gained 23 per cent to Rs 6,297 crore from Rs 5,099 crore a year ago.

IDBI profit jumps 60%

IDBI Bank posted a 60 per cent jump in net profit to Rs 1,323 crore as against Rs 828 crore in the year-ago period. its NII come grew to Rs 6,035 crore from Rs 4,978 crore in the corresponding quarter a year ago.

RBL net rises 46%

RBL Bank on Saturday reported a 46 per cent jump in its September quarter net profit at Rs 294 crore, helped by a margin expansion and healthy core income growth against Rs 202 crore in the year-ago period.