ICICI Bank on Saturday surpassed analyst estimates when it reported a 49.59 per cent growth in standalone net profits on lower provisions for the quarter ended June 30.

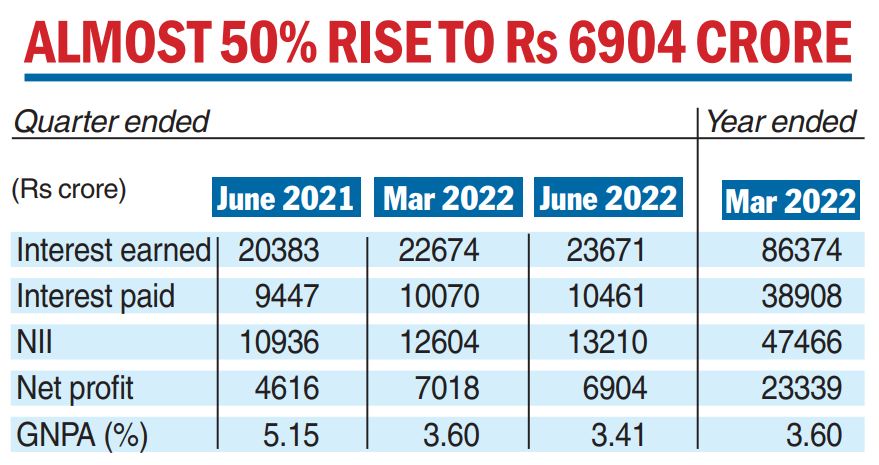

Net profits of the private sector lender rose to Rs 6,904.94 crore from Rs 4,616.02 crore in the same period of the previous fiscal. Analysts had expected the bank to report net profits in the range of Rs 6,400-6,800 crore.

The better-than-expected performance came as provisions dipped sharply to Rs 1,143.82 crore from Rs 2,851.69 crore in the year-ago period. The bank’s core income represented by net interest income (NII-interest earned minus interest paid) also contributed as it grew 21 per cent to Rs 13,210 crore from Rs 10,936 crore in the previous year.

ICICI Bank’s asset quality also showed an improvement with the percentage of gross non-performing assets (NPAs) falling to 3.41 per cent from 3.60 per cent on a sequential basis.

The net NPA ratio also declined to 0.70 per cent from 0.76 per cent during the same period. In absolute terms, its NPAs were at Rs 33,163.15 crore against Rs 33,919.52 crore in the previous three months.

During the period gross additions to the bad loan book were at Rs 5,825 crore (Rs 4,204 crore in the preceding quarter) of which the slippages from retail, rural, and business banking stood at Rs 5,037 crore. However, recoveries and upgrades improved to Rs 5,443 crore from Rs 4,693 crore in the January-March period.

On the advances front, all segments contributed resulting in total advances increasing by 21 per cent year-on-year and 4 per cent sequentially to Rs 8,95,625 crore. Of this, the retail loan portfolio grew 24 per cent over the previous year period and comprised 53.1 per cent of the total loan portfolio.

The business banking portfolio grew 45 per cent over the previous year period while the SME business, comprising borrowers with a turnover of less than Rs 250 crore rose 32 per cent during the same period. It, however, declined 3 per cent on a sequential basis.

ICICI Bank’s deposits increased 13 per cent over the same period in the previous year to Rs 10,50,349 crore (Rs 9,26,224 crore) . Of this, the low cost current account and saving account deposit (CASA) showed a rise of 15.8 per cent to Rs 4,92,114 crore (Rs 4,25,101 crore).

While current account deposits showed a rise of 18.4 per cent, the saving account deposits grew 14.7 per cent. Meanwhile, term deposits rose 11.4 per cent to Rs 5,58,235 crore.