Other housing finance firms and NBFCs also came under pressure as markets thought the sectors were experiencing a liquidity crunch and that those mutual funds holding IL&FS bonds may have to sell the papers of other firms to make good any possible loss.

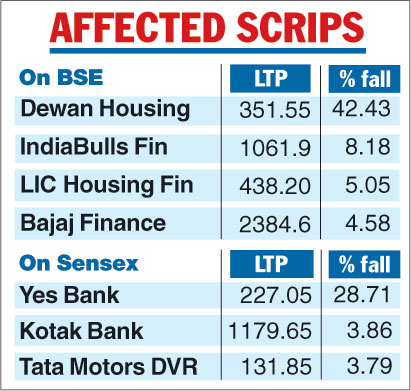

Consequently, the scrip of Dewan Housing went into a tailspin, as it tanked 59.67 per cent to Rs 246.25 — its 52-week low in intra-day trades. Though it recovered some of the losses after the management clarified that it had not defaulted on any bonds or repayment nor did it have any exposure with IL&FS — the scrip still ended 42.43 per cent down at Rs 351.55 on the BSE. As a result, its market valuation tumbled Rs 8,120.41 crore to Rs 11,031.59 crore on the BSE.

Speaking to The Telegraph, Sanjiv Bhasin, executive VP-markets & corporate affairs at IIFL, said the developments at IL&FS were affecting the money market in terms of cost of liquidity.

“The real elephant in the room is the IL&FS imbroglio and that is putting pressure on commercial paper, short-term deposits.. and the cost of liquidity has gone up… The government will have to step in and then only will it be back to business.’’

Some of the other NBFC stocks that got sold off were Indiabulls Housing Finance, which plunged over 8 per cent, LIC Housing Finance, which fell by over 5 per cent, and NBFC stocks such as Bajaj Finance.

On the BSE, the Sensex, which opened on a strong footing at 37278.89, suddenly plunged in afternoon trades to hit a low of 35993.64. It soon staged a sharp recovery to finally close at 36841.60, down 279.62 points. It saw an intra-day swing of 1495.60 points. The broader NSE Nifty shed 91.25 points to finish at 11143.10.

Over the past four sessions, investors have lost a massive Rs 5.6 lakh crore.

Stock market pundits were scrambling to find explanations for the sudden, precipitous fall on the bourses on Friday — and agonised over the pangs that lay ahead before signs of stability creep into the markets.

A wave of panic swept through the market prompting investors to dump shares in a mid-afternoon mayhem that saw the Sensex plummet by 1127.58 points amid fears of a severe liquidity crunch in housing finance companies.

Investors have been spooked over the past few weeks by a tumbling rupee, rising oil prices, growing trade tensions between the US and China and the prospect of economic sanctions against Iran.

But on Friday, the attention turned to domestic concerns with the market cratering over worries that the default at IL&FS would have a knock-on impact on at least a few non-banking finance companies (NBFCs) and housing finance firms.

The panic was accentuated by the news that a fund had sold the debt instruments of Dewan Housing Finance Corporation at a much higher yield, triggering a flight out of stocks.