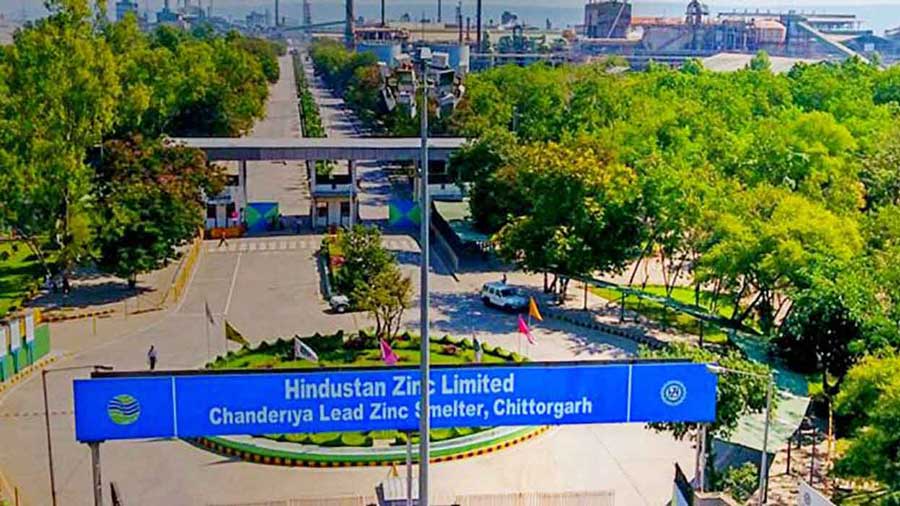

The government is preparing to hire merchant bankers for advice on the sale of its residual stake in Hindustan Zinc Ltd — to be done in tranches.

The government owns 29.54 per cent of Hindustan Zinc (HZL), while Vedanta Group holds 64.92 per cent of the company. The stake sale is likely to fetch the government about Rs 38,000 crore.

Finance ministry sources said the bids would be called in the next few weeks to select the financial advisor for the HZL stake sale. With the privatisation of BPCL on the back burner, HZL is one of the few big-ticket selloffs of the government in this fiscal year.

The cabinet had last month approved a proposal to divest the entire residual stake in HZL, which will boost its revenues, hit by a cut in the excise duties on petrol and diesel to tame inflation.

Earlier, the Supreme Court in November allowed the Centre to disinvest its residual stake in HZL in the open market.

The apex court allowed the sale as HZL ceased to remain a government company since the sale of its majority stake in 2002.

Vedanta chairman AnilAgarwal recently said the company can buy just 5 percent additional stakes in the HZL considering the price of the shares on offer.

Besides HZL, topping the government’s disinvestment agenda is the privatisation of IDBI Bank and Container Corporation