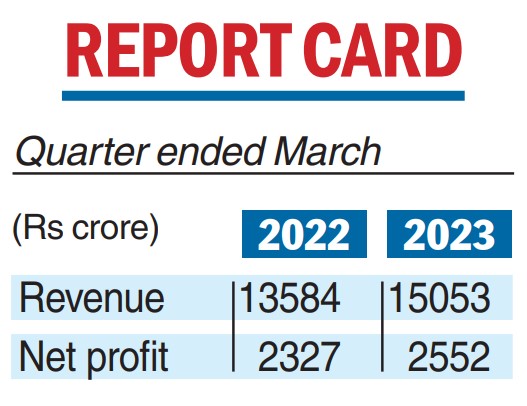

FMCG giant Hindustan Unilever reported a modest 4 per cent volume growth that resulted in a 9.7 per cent increase in Q4 standalone net profit at Rs 2,552 crore from Rs 2,327 crore in the same quarter a year ago.

Total revenue came in at Rs 15,053 crore, rising 10.81 percent from Rs 13,584 crore in the year-ago quarter, the FMCG major said.

Revenues and volumes have lagged market expectations — and the stock was hammered on the bourses, falling 1.46 per cent to Rs 2,468.20.

Outgoing CEO Sanjiv Mehta said: “If we get a good monsoon and 6-6.5 per cent GDP growth, volumes will improve. But for that to happen, commodity prices need to come down.”

Mehta added that HUL had stopped marking up prices, one of the reasons that has impacted volume growth.

The company proposed a final dividend of Rs 22 per share, subject to approval of shareholders at the AGM. Together with interim dividend of Rs 17 per share, the total dividend for the year amounts to Rs 39 per share, up 15 per cent YoY.

With the final dividend, the FMCG firm reported a total dividend of Rs 9,163 crore for FY23 against Rs 7,989 crore in FY22.

The consolidated net profit of the FMCG major rose 12.74 per cent to Rs 2,601 crore. The company had posted a net profit of Rs 2,307 crore in the January-March quarter of the previous fiscal.

Consolidated net sales stood at Rs 14,926 crore, up 10.83 per cent from Rs 13,468 crore in the corresponding period a year ago.

HUL’s total expenses were at Rs 11,961 crore in Q4/FY23, against Rs 10,782 crore a year ago. Total consolidated income in the March quarter, including sales, service and other operating revenue, was Rs 15,375 crore.

In the March quarter, HUL’s home care segment delivered a “solid performance” with an 18.84 per cent revenue growth to Rs 5,637 crore. It was at Rs 4,743 crore in Q4/FY22.

“Both fabric wash and household care grew in strong double digits. The premium portfolio continued to outperform driven by effective market development actions,” said HUL.

Similarly, its revenue from beauty & personal care was up 10.83 per cent to Rs 5,257 crore. It was at Rs 4,743 crore a year ago.